They think their pensions are OK, too

This guest post is by Roger Kerson, a Michigan-based media consultant for labor unions, environmental groups, and non-profit organizations. He was director of public relations at the United Auto Workers during the GM and Chrysler restructuring. As an associate of the Arlington, Virginia-based firm PRWRK, he has provided strategic counsel to the Transport Workers Union of America during bankruptcy at American Airlines and to the United Mine Workers during bankruptcy at Patriot Coal.

Aren’t you tired of all those overpaid, underworked public employees, who are bankrupting cities like Detroit with their lavish pay and pensions?

No. you’re not. You read Eclectablog and you know better.

Turns out, everybody else knows better, too. In a nifty scoop that reveals how elites work to shape public opinion, Salon writer David Sirota uncovered the findings of a poll on public attitudes (pdf) toward public employees and their pensions.

And what do you know? Despite intense efforts by conservative think tanks and their allies in both parties to demonize public sector workers and blame them for the fiscal woes of states and cities, the public actually likes public employees, by whopping margins.

When we say “like,” we’re talking Sally Field territory. Pollsters measure “net favorability,” which means subtracting the people who don’t like you from the people who do. Have a look:

Chart from Mellman Group/Public Opinion Strategies via Salon

Teachers are net favorable by 88 percent. Cops and firefighters by 86 percent, and generic state employees by 60 percent. Even the dreaded teachers unions get a 34 percent positive ranking.

Better than Barack: By contrast, Barack Obama’s current net favorable rating, according to Gallup, is at negative 13 percent, which means those of us who like him are significantly outnumbered by those who don’t. The president shouldn’t feel too bad. Back in October, shortly after the government shutdown, Gallup found Mitch McConnell clocking in at minus 20 percent, with John Boehner even lower at minus 24 percent.

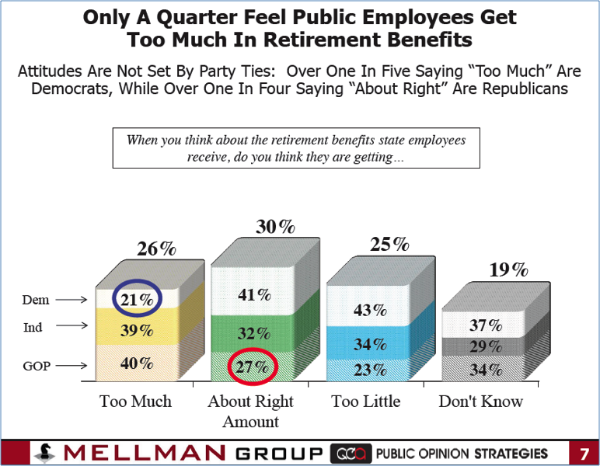

Given the high favorability ratings for public employees, it’s not surprising that the poll doesn’t show much support for the concept – widely touted by so-called “reformers” – that overly generous public pensions must be restructured and reduced. Fifty-five percent say retirement benefits for state employees are “about right” or “too little,” while just 26 percent say benefits are “too much.”

Chart from Mellman Group/Public Opinion Strategies via Salon

Is Pew Fronting for the Elite Few? The poll on public employees is one of those bipartisan thingies, conducted by a top Democratic research firm (the Mellman Group) and a top Republican one (Public Opinion Strategies [POS]). It was commissioned, according to Sirota, by the Pew Center on the States. (Pew did not return a phone call or email seeking comment.)

The Center on the States is a project of the Pew Charitable Trusts, a supposedly non-partisan charitable foundation. But a research report prepared by Sirota earlier this year for the Institute for America’s Future – and a devastating critique by the indispensable Matt Taibbi at Rolling Stone – charge that Pew has teamed up with a conservative cabal in a long-term effort to cram down retirement compensation for public workers.

It’s a long and sordid tale, but here’s the short version: Wall Street greedheads wrecked the retirement security of tens of millions of Americans by selling junk mortgage investments to pension funds which lost billions in value during the 2008-2009 financial crisis. These same estimable citizens now claim that existing retirement systems for public employees are “unsustainable” and must be “reformed” by turning even more money over to…. Wall Street greedheads.

In Rhode Island, for example, State Treasurer Gina Ramaindo (a Democrat, Rhodes Scholar and former venture capitalist) pushed through pension “reform” in 2011 which sharply reduced retirement compensation for state employees, while increasing fees paid to fund managers.

As Taibbi reports:

[Former SEC attorney Ed] Siedle projects that the state will pay $2.1 billion in fees to hedge funds, private-equity funds and venture-capital funds. Why is that number interesting? Because it very nearly matches the savings the state will be taking from workers by freezing their Cost of Living Adjustments – $2.3 billion over 20 years.“That’s some ‘reform,'” says Siedle.

“They pretty much took the COLA and gave it to a bunch of billionaires,” hisses [Stephen] Day, Providence’s retired firefighter union chief.

If this sounds familiar, it’s because similar scams are being run all over the country. In Detroit, for example, unelected emergency manager Kevyn Orr is proposing that the debt-soaked city – which he took into bankruptcy – take on a new $350 million loan from Barclay’s Bank.

Will the money be used to shore up critical city services, or to cushion the blow for city retirees facing draconian cuts in their $19,000-per-year pensions? Nope. Most of it will go to pay a “termination fee” to Bank of America, to get the city out of a disastrous interest-rate swap that BoA, UBS AG and SBS Financial Products engineered in 2009. The deal was premised on a bet that interest rates would go up; they went down instead, costing the cash-strapped city tens of millions of dollars a year.

Welcome to the wonderful world of pension “reform.” If you work for the taxpayers, you get screwed. But if you screw the taxpayers…. you get paid.

Is this what democracy looks like? If a huge majority of voters have a favorable view of public employees and don’t think pensions are too high, then how can politicians get away with slashing benefits?

Sometimes they can’t. In Cincinnati, for example voters just resoundingly defeated, by a 78-22-margin, a Tea Party-sponsored measure that would have whacked pensions for city workers.

In Michigan, when it comes to governing our cities, we don’t get to do the “voting” thing so much anymore. In addition to Detroit, three school districts and four cities are now ruled by unelected Emergency Managers, some of them for the second time! Two other cities are under “transition advisory boards” after spending time under the rule of an Emergency Manager. In fact – as Eclectablog pointed out back in February – fully half of the state’s African-American population now lives in cities where that are run by somebody who nobody ever voted for.

But… the guy who signed the emergency manager law – twice – and then appointed a bunch of them does have to run for re-election in 2014. I’ve been thinking for a while that Rick Snyder will benefit from showing tough love to Detroit and other cities (even if there’s plenty of tough and not much love.) He was never going to get many votes in Detroit anyhow – but Detroit-bashing has long been a popular sport in suburban counties. And that’s where you’ll find many of the swing voters who actually decide elections.

The Mellman/POS poll suggests a re-think might be in order. If public opinion in Michigan matches their nationwide sample, the Nerd could be vulnerable to a line of attack asserting that he’s been too harsh on public workers, but too easy on the banksters.

Is Michigan different? The “if” in that last sentence, by the way, is pretty huge. Mellman/POS surveyed 1,000 voters nationwide, which means just a handful from Michigan. There are all kinds of reasons public opinion could be different here. Take your pick: Detroit’s well-publicized problems. The near-death of the domestic auto industry. The defeat of Prop 2 and the ensuing stampede in the state legislature to make Michigan a so-called “right-to-work” state.

How has all this affected what Michigan voters think about public workers and how they are treated by public officials? I don’t know. But, if I were Gary Peters or Mark Schauer, I’d certainly want to know – and I’d be asking my own pollsters to include this topic in their next survey.

[Arrow image: FreeDigitalPhotos.net]