The reviews are in!

The GOP went too far to help corporations in its new tax bill, says Marco Rubio, who voted for the bill after “winning” concessions that deliver $0.00 to $6.25 a month to some of America’s poorest families.

“If I were king for a day, this tax bill would have looked different. I thought we probably went too far on (helping) corporations,” Rubio told the News-Press of Fort Myers. “By and large, you’re going to see a lot of these multinationals buy back shares to drive up the price. Some of them will be forced, because they’re sitting on historic levels of cash, to pay out dividends to shareholders.”

My favorite critic of Marco Rubio’s moral failings is Marco Rubio.

Where Paul Ryan and Ted Cruz and Lindsey Graham have surrendered completely to Donald Trump in exchange for Donald Trump enacting Mike Pence’s agenda, or other more desperate reasons, Rubio pretends to be pained by the moral failings of his party’s agenda, as he crumbles to them. Just as he crumbled by endorsing Trump a man Rubio still won’t say he trusts with nuclear weapons.

It’s only when Rubio is criticizing Rubio that Rubio makes decent points.

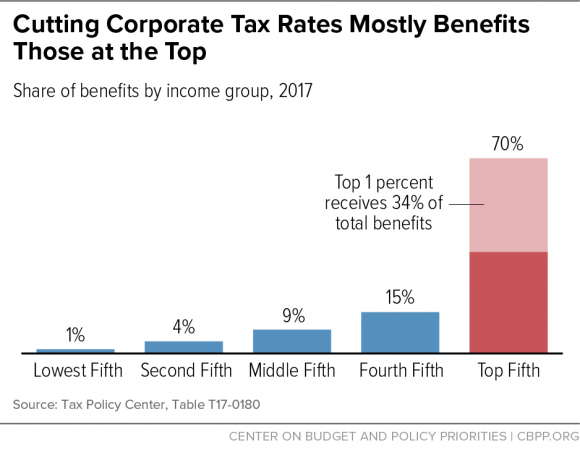

Corporate tax cuts, especially ones that are happening when corporations have historic stockpiles of cash, primarily help the rich, as the Center for Budget and Policy Priorities has noted all year.

You can argue that these cuts, like cuts for the richest Americans who have never been richer, only help the rich because the GOP is planning to “pay for them” by cutting benefits working Americans have earned — starting with Medicaid.

The reviews are in and this bill, which gives 82 of its benefit to the richest 1 percent while eventually raising taxes on most Americans, is bad.

And these are reviews are from Republicans, as Jon Favreau pointed out:

Susan Collins: “The increased premiums would be more than the tax reduction some people get from this bill.”

Lindsay Graham: “Financial contributions will stop if we don’t pass this.”

Trump, to Mar-a-Lago members: “You all just got richer.”

It’s important to remember that this bill kept getting more and more and more slanted to the Trump’s pals at Maralago, sustaining loopholes for Wall Street bankers and expanding them beyond recognition while even cutting the top tax rate. This was after the White House, especially when Steve Bannon was working there, pretended that it might even add a new bracket for the richest Americans.

How did Republicans end up with a bill that appears to be designed by Trump’s kids’ accountants?

“Behind the scenes, according to aides, lobbyists and fellow lawmakers, [Pat] Toomey played a major role in shaping the Republican tax overhaul — pushing not only for a cut in the top individual rate but also helping slash rates for corporations and repeal a key provision of the Affordable Care Act,” the Washington Post reported.

Toomey is a former investment banker who previously headed Club for Growth, a DC conservative 501(c)(4) that pushes the kind of tax cuts and elimination of corporate protections that led to the last Republican financial crisis.

If you’re in Michigan, you might recognize the Club for Growth as the group that gave Tim Walberg more than half a million dollars to win his first GOP primary back when Toomey was running the group.

Walberg just voted for a law that could give Trump $30,000 A DAY in tax cuts, which is about 16 times what the average family can expect from this law IN A YEAR before its benefits fade away.

Imagine backing bill designed to help the rich game the system with massive, unfunded tax cuts after a decade of pretending to stay up nights crying over the deficit.

We know what investment bankers like Pat Toomey got from Tim Walberg. But what did he get you?

[Image Photo by Gage Skidmore | Flickr]