5 reasons Trump’s tax scam won’t improve the GOP’s prospects

Twas the night before the night before Christmas when Donald Trump did what villains in action movies are supposed to do. He interrupted the story to explain his evil plan.

“You all just got a lot richer,” the president told the crowd at Mar-A-Lago, his for-profit club where he sells access to the presidency and golf.

Polls have shown that the trillion dollar tax giveaway for the rich and their kids and their businesses is the least popular piece of legislation in the history of polling, primarily because the public believes it will primarily benefit only the people like residents of Palm Beach who can afford $200,000 a year to hang with Trump.

And though his approval has ticked in the Gallup ratings to a still historically low 39 percent up since the bill passed, there’s still good reason to believe the law will do more to hurt Republicans chances in 2018 than help them, even after tax cuts start showing up in some checks in February.

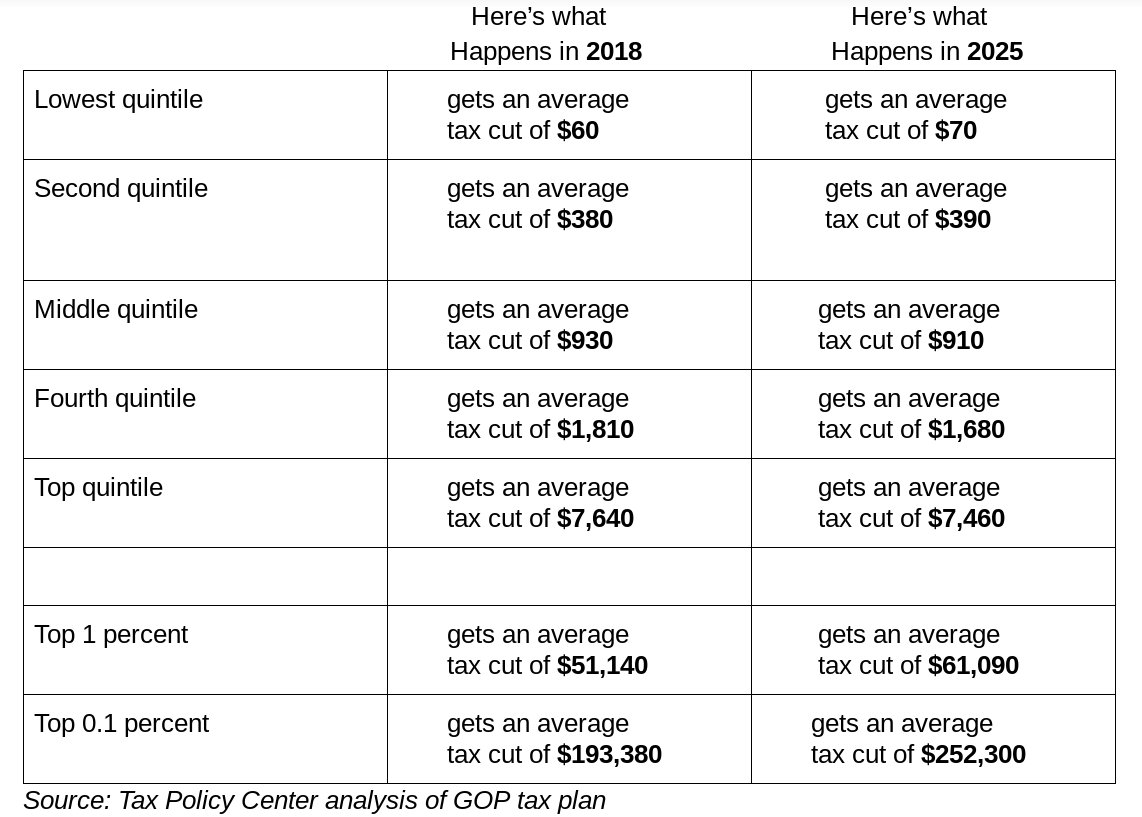

1. The guys who don’t need get a tax cut get one that’s 3,223 times bigger than the Americans who do.

Check out this chart from Greg Sargent:

If you’re one of the poorest Americans, this tax cut is on average worth to you about 17 cents a day because you’re only raking in $60 a year from the cuts. On average, the richest Americans will take in more than 8 times that amount, $529, in tax cuts — every day. The top quintile of Americans will likely see bigger paychecks and they’re the Americans mostly likely to own stocks, likely bolstered by corporate tax cuts. But the remaining 80% of America will see on average $35 a week or much less, which will feel like nothing or next to nothing given the way most paychecks vary.

There’s a reason that Democrats have long leaned on the line “the rich should pay their fair share.” It makes a ton of sense given the extraordinary opportunities they’re afforded by the public’s investments. The idea that Scrooge needs a tax cut 3,223 bigger than Bob Cratchit only makes sense to Scrooge, and only before he’s met even one ghost.

2. Americans intuitively understand who the GOP wants to pay for these cuts.

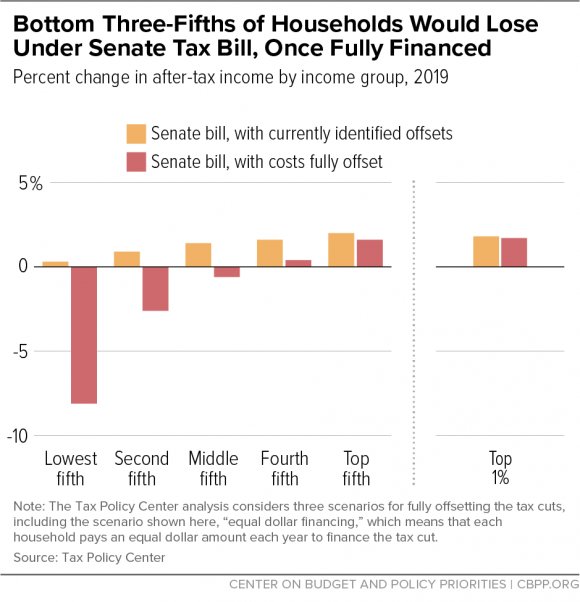

But the problem with this bill isn’t that it does little to help the poorest. The real problem is that it will actively hurt the poorest, as the chart from Tax Policy Center explains:

“If you consider plausible ways of financing either the House or the Senate bill, most low-and middle-income households would eventually end up worse off than if the bill did not become law,” William G. Gale writes. “In other words, they would lose more from inevitable future spending cuts or tax hikes necessary to eventually offset the costs of the tax bill than they would gain from the tax cuts themselves.”

Is $3 a day in tax cuts worth losing Medicare, Medicaid and Social Security as we know them?

That’s a question voters will likely be asking themselves a lot in the next few months, especially if Republicans focus on cuts to Medicaid and Social Security Disability Insurance as they’ve been been promising to do under the guise of “w*lfare reform,” a term you should never use because it’s dishonest and a racial dog whistle. These are just cuts to programs Trump promised not to cut and if that gets pointed out often enough, these tax cuts could get even less popular.

3. The guys selling the plan are all huge beneficiaries of it, unlike you.

Who is going to sell this bill?

Ivanka Trump is “really looking forward to doing a lot of traveling in April when people realize the effect that this has.” Of course she can also look forward to the benefits it has for her and her family:

Assuming the full benefit of this, the CAP roughly estimates a tax cut of $11m to $15m for Trump (based on an estimate of $150m of passthrough income from reviewing his financial disclosure, and the $109m in real estate/pass-through income on his 2005 tax return); $5m to $12m for Jared Kushner, White House senior adviser and Trump’s son-in-law; and $2.7m for Betsy DeVos, the education secretary.

Ivanka Trump can also look forward at a $4.5 million break on the inheritance tax, or 4,838 times what a middle income American will get out of this tax cuts in a year.

4. Many will end up paying more because of increased increased premiums.

The repeal of the individual mandate breaks Obamacare into two programs — Obamacare for the 80% or so of Americans who visit HealthCare.gov and get some form of subsidy and Trumpcare for the rest of America who can expect 10% premium increases on top of typical increases, every year. These Americans tend to be older and more rural. In other words, they tend to be Republicans. And they’ll find out out how much their premiums will go up right before Election Day 2018.

5. This scam may confirm the public’s worst fears about Trump.

People have wondered: can Trump approval rating remain at 40% or less even w/economy performing so well? This story, and Trump's own tweets on FBI today, are why the answer is: yes they can. He faces a harsh personal judgment from many voters that is disconnected from conditions https://t.co/BUU8K5WAh3

— Ronald Brownstein (@RonBrownstein) December 23, 2017

Most Americans think Trump is corrupt, boorish and dishonest. A wide majority of us want him to release his tax returns and no one is assuming he’s not releasing them now because he’s modest. We know he’s hiding something.

The Comey letter was disastrous for Hillary Clinton because it seemed to confirm or at least activate many Americans worst suspicions about her. Trump’s continual gloating about his wealth and evasions about paying his fair share could have the same effect on him in slow motion.

Of course, there’s one huge way this does help Republicans.

Their donors now have billions more to play with and politicians to reward for their fawning abeyance. We can never underestimate how difficult it is to take back the House given how badly Republicans have bent democracy:

If the U.S. House was decided proportionally to votes, Democrats would have a 97% chance of winning a majority next year.

Instead, since seats are gerrymandered and Democrats are clustered in cities, Democrats are only 59% (!) to win.. https://t.co/jSkahUl6Ci

— G. Elliott Morris📈🤷♂️ (@gelliottmorris) December 22, 2017

But these tax cuts skewed to the richest will certainly help us make our case.

[Picture by Michael Vadon | Flickr]