That advice wasn’t good for consumers. But it sure must have been good for Trott’s business handling foreclosures.

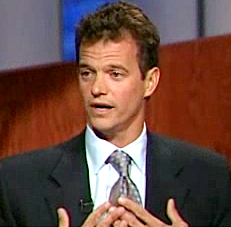

David Trott, chairman and CEO of one of the country’s largest law firms specializing in foreclosure services for the mortgage industry — and a Republican candidate running in Michigan’s 11th Congressional District — has got some explaining to do.

David Trott, chairman and CEO of one of the country’s largest law firms specializing in foreclosure services for the mortgage industry — and a Republican candidate running in Michigan’s 11th Congressional District — has got some explaining to do.

In September 2007, subprime mortgage firms were declaring bankruptcy, other financial institutions were refusing to take on more subprime loans and millions of Americans were at risk of losing their homes. At that same time, Trott appeared on the Michigan TV program “Due Process” and called subprime mortgages “a perfectly appropriate product.”

Yes, David Trott defended subprime mortgages even as the subprime mortgage market was collapsing. That collapse contributed significantly to the larger financial crisis that wreaked havoc on the global economy.

Trott’s statements on “Due Process” make it clear he didn’t see anything wrong with endorsing a product he knew very well would result in even more foreclosures — risking the homes of average Americans while driving more business to his law firm.

CLICK HERE for video. If video does not pop up in a new window, CLICK HERE.

The episode of “Due Process” above, which aired September 7, 2007, is worth watching to get the big picture. But here’s a transcript of this key segment:

Host Henry Baskin: David, let me ask you this: Everybody who ever bought a home in the history of our country would say, ‘Hey, this is a great investment. Price always goes up. They never make new land and you can’t lose money on real estate.’ But how does this affect their inability to pay? I don’t understand. Say the home is worth exactly what they paid for it, $250,000. It’s not worth less. It’s still worth $250,000. What’s happened?David Trott: Well, if the person bought that house, perhaps on a subprime mortgage product, which I agree with Nina, I think is a perfectly appropriate product and a lot of borrowers are real successful in subprime products so across the board they’re not bad. But if they went to subprime and they based that subprime loan app on overtime with General Motors and General Motors cuts back on the overtime, even though that property is still worth $250,000 they don’t have the wherewithal to make the monthly payments.

The way Trott spins it, you’d think the problem was all about the economy — not subprime mortgages. But Nina Rodriguez, who he refers to in his comment, didn’t actually say subprime mortgages were an “appropriate product.” His co-panelist on the show, Rodriguez, who was with Southwest Housing Solutions, a Detroit non-profit dedicated to helping people buy and stay in their homes, said this about subprime borrowers right before Trott answered Baskin’s question:

History has shown that borrowers with lower incomes and blemished credit can be succesful homeowners if they’re put in suitable products with reasonable interest rates, reasonable fees. But what’s happened is that we’ve had lax underwriting practices, people have been put in dangerous loan products, and there’s been a total disregard for affordability. What can people truly afford?

Does that sound like a full-throated endorsement for subprime mortgages? Hardly. Subprime mortgages charge higher interest rates, qualifying them as a “dangerous” loan product in a tough economy where they were already causing significant damage.

Rodriguez brings up the key problems with the mortgage financing industry that led to a glut of foreclosures. A glut that must have been very, very good for Trott’s firm, Trott & Trott, P.C., which specializes in real estate finance default legal work, such as default servicing, bankruptcy, eviction and litigation. Their clients include mortgage bankers, banks, credit unions, mortgage servicers, regional property owners and investor groups.

And consider this: Trott defended subprime mortgages on TV less than a month after the Federal Reserve lowered the interest rate it charges banks. When the Fed took that action on August 17, it was acknowledging for the first time that an extraordinary policy shift was needed to contain the subprime mortgage collapse, according to Bloomberg.

Why would Trott do that? Because he was betting against average consumers in a bid to generate more business for his law firm.

On the “Due Process” segment, Trott tried to position his firm as the good guys, willing to go to great lengths to help people keep their homes. He boasted that his firm worked with its clients to offer a “Cash for Keys” program that would give people who couldn’t pay their mortgages $5,000 to move out of their houses. Struggling homeowners — perhaps out of work at the time — got a whopping $5,000 for their homes, while Trott & Trott made a profit just for processing the paperwork. The firm profited and homeowners were left with almost nothing.

Plus, it’s not as if Trott’s firm stopped circling like vultures once the housing market started improving. In 2011, Trott & Trott was involved in a 101-year-old Detroit woman being kicked out of her home after more than 50 years because her son didn’t pay the mortgage or taxes. Sure, those bills should have been paid. But what kind of heartless person drives a woman that age out of her home instead of working out an arrangement, no matter what it takes?

The kind of person who would say this on “Due Process,” as Trott did in 2007, regarding people who said they were in default because they didn’t understand how an Adjustable Rate Mortgage worked:

I think some of the folks have selective recall. They understood that they were in ARMs, and now that it’s gone up and adjusted by 6 percentage points they sure can’t afford to pay that mortgage.

Rodriguez argued against that, explaining that many of the people her non-profit served had been misled — even to the point of Spanish-speaking people not being given guidance in Spanish.

On his campaign website, Trott (who is going by Dave, presumably to give him that folksy, “I’m just like the rest of you” vibe), touts his business experience as a job creator. He’s clearly contrasting himself against incumbent Rep. Kerry Bentivolio , an extremist the GOP is fleeing from faster than a flying reindeer. Now they’ve moved on to a corporatist who profits from the misfortune of others and will champion the cause of big business. If you live in the 11th District, do you want a representative who works for the people or one who works against them for personal gain?

According to the Detroit Free Press, Trott had stocked his campaign coffers with $648,519 by September 30 — far outpacing Rep. Bentivolio. Contributions are coming from many of Michigan’s elite, including billionaire corporatist Dick DeVos, Mike and Marian Ilitch and builder Bill Pulte.

Trott isn’t exactly a man of the people — or, apparently, for the people. In fact, I think Trott is beginning to sound a lot like Mitt Romney.

Except instead of firing people, Trott likes to take away their homes for profit.