In March of 2015, Michigan Democrat Jim Townshend introduced legislation in the House – House Bill 4341 – that would change Michigan’s regressive flat state income tax to a graduated tax. Not surprisingly, it never went anywhere in the Republican-controlled House. And that’s a shame because, if implemented, it would increase state tax revenues by as much as

In March of 2015, Michigan Democrat Jim Townshend introduced legislation in the House – House Bill 4341 – that would change Michigan’s regressive flat state income tax to a graduated tax. Not surprisingly, it never went anywhere in the Republican-controlled House. And that’s a shame because, if implemented, it would increase state tax revenues by as much as $700,000,000 $870,000,000 and still lower taxes for 95% of Michiganders.

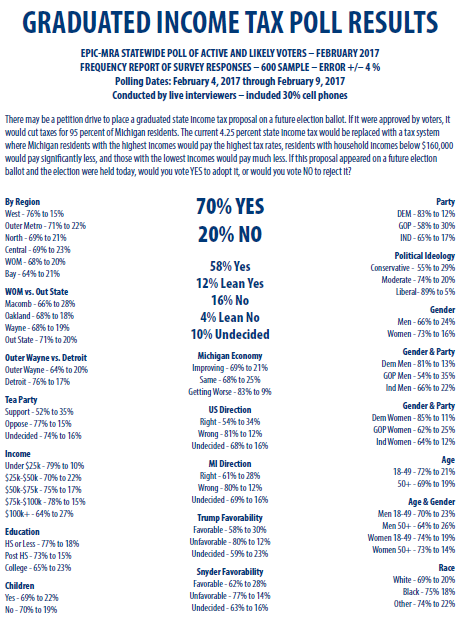

This is the sort of populist, across-the-board, tax policy that could appeal to even people who found themselves voting for Donald Trump in November of last year. Why do I say that? Have a look at these results from a recent EPIC-MRA poll on this topic:

A full 70% of Michiganders favor this tax proposal. It doesn’t matter how you slice the respondents demographically, a majority of people like this idea. A LOT. Even people with incomes over $100,000 a year support it 64% to 27%.

The breakdown on the tax rates looks like this:

3% tax rate on incomes up to $20,000

4% tax rate on incomes between $20,000 and $40,000

5% tax rate on incomes between $40,000 and $80,000

6% tax rate on incomes between $80,000 and $125,00

7% tax rate on incomes between $125,000 and $200,000

8% tax rate on incomes between $200,000 and $500,000

9% tax rate on incomes between $500,000 and $1,000,000

10% tax rate on incomes over $1,000,000

UPDATE: These tax rates are not for ALL of your income, they are for the income up to that point. So, if you make $135,000 a year, the first $20,000 is taxed at 3%, the next $20,000 is taxed at 4%, the next $40,000 is taxed at 5%, the next $45,000 is taxed at 6%, and the final $10,000 is taxed at 7%.

Fortunately, the bill has been reintroduced by Democrat Robert Wittenberg as House Bill 4436.

There’s a lot of talk about why Democrats got their clocks cleaned in 2016 (and in many cycles before 2016.) There’s consensus that, in part, it’s because we focused too much on minority groups and failed to offer anything to “average” middle class Americans. A tax cut for 95% (95%!!!) of Michiganders that raises as much as $700,000,000 is precisely the sort of policy Democrats should be promoting. And the data suggests it would be widely and wildly popular.

Be sure to let your state legislators know that H.B. 4436 has YOUR support and should have THEIR support, too. And, as the graphic above indicates, if they don’t, the citizens of Michigan may well bypass them entirely and put it on the ballot themselves.

[CC image credit: Donkey Hotey]