It may be our only way to “thank” him for all he’s done

In a private ceremony on Tuesday, Rick Snyder signed the Detroit Public School’s “rescue” bill into law. The bill abandoned 15 months of bi-partisan negotiations in favor a giveaway to the charter school industry with almost no accountability.

Meanwhile, for the third straight summer, residents of Flint are still depending on bottled water thanks to decisions made by the governor’s direct reports.

Despite evidence that he’s been in any way humbled or enlightened by the damage done to Flint, cries to “arrest” Snyder or even recall him have faded. This is somewhat understandable given the abundance of challenges we face and the necessity to focus on making sure Republicans don’t send an outwardly bigoted authoritarian to the White House in November. But watching him continue to make decisions that prioritize profit over people is depressing.

We can’t let the only consequences for his actions be a stain on his resume that will haunt his life and any word history has to same about him. That will always be trivial compared to the way his decisions will haunt the people of Flint.

The chances of Rick Snyder lingering in Michigan after his disastrous second term are close to zero, given the ignominy he’s heaped upon himself. So he’ll leave us behind with his toxic legacy and the inevitable budget shortfalls his corporate kickbacks were designed to create.

The very least we can do is use legacy to restore some fairness to this state and cut lots of Michiganders’ taxes.

A new report from the Economic Policy Institute shows members of Michigan’s richest 1 percent are raking in a near record share of all the income in the state. We rank 11th overall in income inequality, one metric where we’re near the top 20 percent, in contrast to ethics and transparency where we rank dead last.

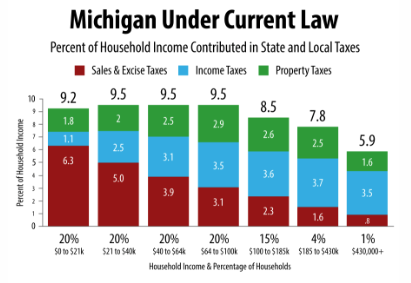

And though the richest residents of the state contribute less than 6 percent of their income in taxes while bottom 80 percent pay between 9.2 and 9.5 percent.

“There is no reason a police officer or a small-business owner making $50,000 a year should contribute nearly twice as much of their income as a billionaire, but that is how our tax system works, for now…” the folks behind Michigan Tax Equality explain.

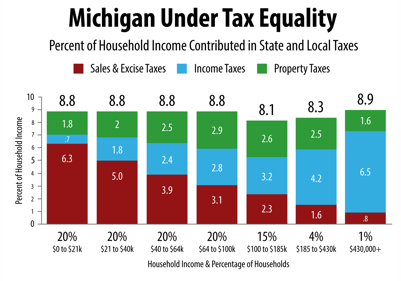

The fix proposed would simply ask residents earning more then $430,000 a year to pay just about the same share of their income as those who earn under $100,000.

The less you earn, the bigger your tax cut.

With the top five percent paying a nearly equal share of their income, Michigan Tax Equality suggests we could:

- Help restore our crumbling roads and bridges.

- Provide our children and grandchildren with the education they need to realize their fullest potential.

- Lower tuition rates so our children and grandchildren aren’t burdened with unimaginable debt.

We could also fix some pipes.

Representative Jeff Irwin has been pushing this legislation for years and perhaps our best hope is to see it on the ballot in 2018, when it’s time to replace this governor.

It’s a shame to think of paying taxes to invest in our society as a punishment. But conservatives have spent four decades pushing that frame. We’re not going to change it overnight, so let’s take advantage of this moment and the righteous anger at Rick Snyder to actually do some good for the state that has been poisoned by his leadership.

You know Rick Snyder is rich — very rich — and he can afford to pay the same tax rate as a nurse or a plumber.

So let’s raise Rick Snyder’s taxes. It’s the very least we can do to “thank” him for his service.