Sorry, Mitt. But you’re going to have to pay some taxes.

With President Obama busy spending much of his time trying to stop House Republicans from purposely destroying the economy in order to get the kind of cuts to Medicare they’ve spent years campaigning against, most of America has missed that we now have what some experts are calling the most progressive tax code since 1979.

With President Obama busy spending much of his time trying to stop House Republicans from purposely destroying the economy in order to get the kind of cuts to Medicare they’ve spent years campaigning against, most of America has missed that we now have what some experts are calling the most progressive tax code since 1979.

The “fiscal cliff” deal raised taxes on the richest that come into effect just as new taxes to fund ObamaCare begin:

That deal includes a host of tax increases on the rich. It raises the tax rate to 39.6 percent from 35 percent on income above $400,000 for individuals, and $450,000 for couples. The rate on dividends and capital gains for those same taxpayers was bumped up 5 percentage points, to 20 percent. Congress also reinstated limits on the amount households with more than $300,000 in income can deduct. On top of that, two new surcharges — a 3.8 percent tax on investment income and a 0.9 percent tax on regular income — hit those same wealthy households.

These taxes are going to the people who can most afford them and have benefited the most even as millions are out of work. Basically, Mitt Romney will go from paying around a 9%-13% tax rate to something closer 20%. Will that stopping him from “taking risks” like sitting around and reaping massive gains from investments he made a decade ago? Not likely.

After taxes went up on the rich in 1993, a massive economic boom followed. You can’t say the tax increases caused the longest economic expansion in American history — though conservatives would surely crow if tax cuts led to such a boom — but it certainly didn’t prevent it.

65 years of shifting the tax burden from the rich to the middle class hasn’t led to growth as promised, instead it’s led to a massive accumulation of wealth by the richest 1%, according to report by the Congressional Research Service.

The results of the analysis in this report suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth. The reduction in the top statutory tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie. But as a small proportion of taxpayers are affected by changes in the top statutory tax rates, this finding is not unexpected.

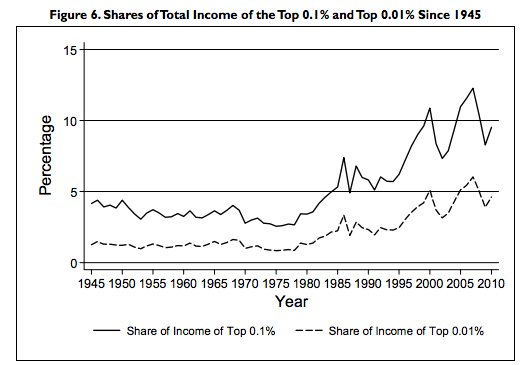

However, the top tax rate reductions appear to be correlated with the increasing concentration of income at the top of the income distribution. As measured by IRS data, the share of income accruing to the top 0.1% of U.S. families increased from 4.2% in 1945 to 12.3% by 2007 before falling to 9.2% due to the 2007-2009 recession. At the same time, the average tax rate paid by the top 0.1% fell from over 50% in 1945 to about 25% in 2009.

We’ve reversed this trend of ever increasing giveaways and we’ve done for a crazy reason: to make sure all Americans have access to life-saving healthcare.

There are imperfections in everything, which is why I oppose all purity tests except for food and drink. I keep wondering who will be the 2016 Democratic presidential candidate, for instance, who proposes saving $100 billion over the next decade by implementing a public option.

The Bush tax cuts were designed to break a budget that had been balanced to justify eventual cuts to government services. I still believe that. Thus we still have a structural deficit that will require extraordinary growth to fix, something the GOP will do whatever they can to prevent until they take the White House.

But let’s not miss the big story here: Those who benefit the most are being asked to pay more to help making America a healthier fairer place. That sounds suspiciously like change I can believe in.