The impact of new Republican taxes in Michigan is about to get very real

Back in February, I wrote piece titled “The tax timebomb that explodes in Michigan in 2012 is MUCH worse than you thought”. The piece got a lot of attention, primarily because it was a big news flash that in order to pay for the billions in giveaways to Michigan corporations, Michigan Republicans raised taxes on over half of the people in Michigan. And, make no mistake, true to (Republican) form, the impact was far greater on lower income Michiganders than on our wealthiest citizens.

Back in February, I wrote piece titled “The tax timebomb that explodes in Michigan in 2012 is MUCH worse than you thought”. The piece got a lot of attention, primarily because it was a big news flash that in order to pay for the billions in giveaways to Michigan corporations, Michigan Republicans raised taxes on over half of the people in Michigan. And, make no mistake, true to (Republican) form, the impact was far greater on lower income Michiganders than on our wealthiest citizens.

Here’s what I wrote last winter:

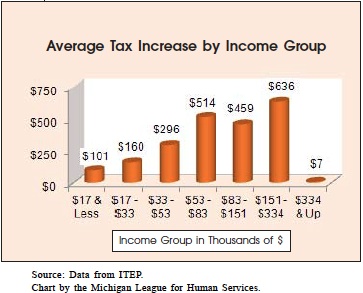

What is shocking is how easy the budget goes on upper income Michiganders and how astonishingly HARD it hits lower income residents. Take a look at the average tax increase broken down by income group:

In fact, when you look at the total state and local taxes as a percentage of income of those making $334,000 or more per year vs. those making $17,000 year or less, the poorest people pay 1000 times more than those at the top of the food chain. The poorest Michiganders pay 1.0% of their income vs. 0.001% for the top earners.

Other things from the report that you should know about the tax time bomb that explodes in Michigan in 2012:

- Despite continuous Republican screeching about “simplifying the tax code”, this new budget decidedly does NOT make it less complicated.

- Reduces the Earned Income Tax Credit (EITC) for the working poor from 20% to 6% of the federal credit – a 70% cut.

- Lowest 20% of income earners pay 9.1% of income in state & local taxes, top 1% pay only 5.6%.

- All major tax credits except the Homestead Property Tax Credit are now gone. Donations to food banks, shelters, and food kitchens: gone. Donations to charities: gone.

- Taxes are instituted or increased on private and public pensions for certain groups of senior citizens/retirees.

- Deduction for children in the family has been eliminated.

- Homestead Property Tax Credit (HPTC) has been taken away for over a quarter million Michiganders with incomes between $50,000 and $82,650. Seniors with incomes between $30,000 & $50,000 will have this credit reduced by 40%. Only half of the working poor that qualify for the EITC will also qualify for the HPTC.

At the end of the day, here’s a very important thing to remember: Thanks to the new Republican budget, 51% of all Michigan tax payer will pay MORE in personal income taxes in 2012 and beyond. Read that again. Over HALF of Michiganders will pay MORE TAXES because of the Republican budget. This is not Democrats. This is not even the Republicans of yesterday. This is, in fact, a mostly tea party-driven legislature who came in on a small government, less taxes bandwagon, tooting horns and banging tambourines.

And they just raised taxes on over half of our residents.

A thousand times more taxes based on income for our poorer residents AND we’re reducing or entirely eliminating a key tax credit, the Homestead Property Tax Credit, for many of them.

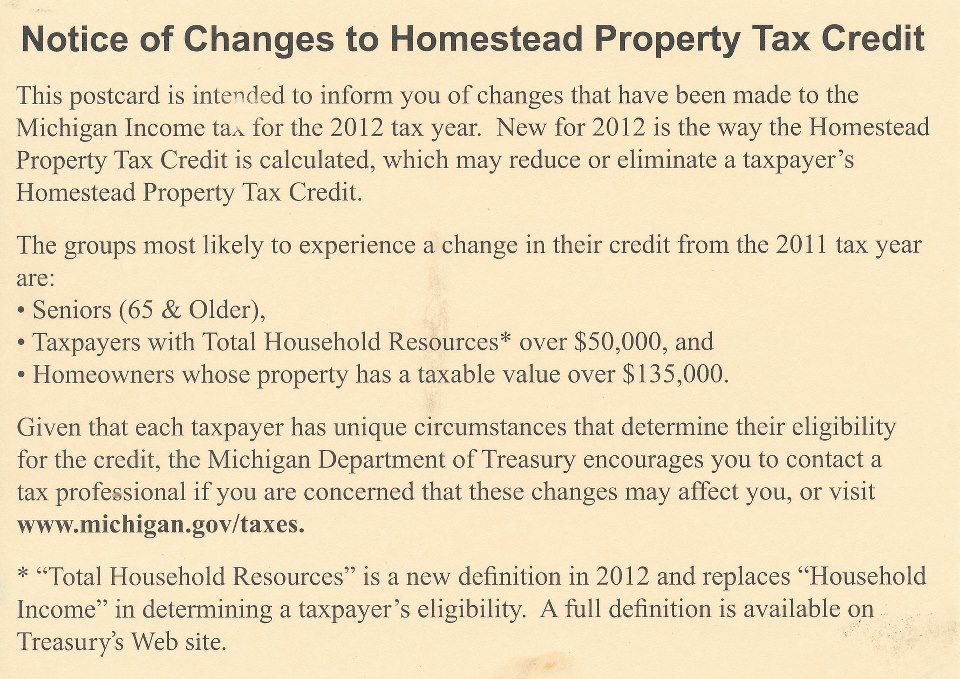

Well, this week, the postcards from the State of Michigan arrived in mailboxes across the state, telling these folks to expect to take the hit. Here’s the one my friend Rochelle N. received:

Notice of Changes to Homestead Property Tax Credit

This postcard is intended to inform you of changes that have been made to the Michigan Income tax for the 2012 tax year. New for 2012 is the way the Homestead Property Tax Credit is calculated, which may reduce or eliminate a taxpayer’s Homestead Property Tax Credit.The groups most likely to experience a change in their credit from the 2011 tax year are:

- Seniors (65 and older)

- Taxpayers with Total Household Resources* over $50,000

- Homeowners whose property has a taxable value over $135,000

Given that each taxpayer has unique circumstances that determine their eligibility for the credit, the Michigan Department of Treasury encourages you to contact a tax professional if you are concerned that these changes may affect you, or visit www.michigan.gov/taxes.

* “Total Household Resources” is a new definition in 2012 and replaces “Household Income” in determining a taxpayer’s eligibility. A full definition is available on the Treasury’s Web site.

That bit at the end is interesting. The main difference between “Total Household Resources” and “Household Income” is that you can no longer take into account “business, farm, rental and royalty income or loss”. If you lost money this way, you used to be able to subtract it, reducing your overall income (and paying less taxes.) Now you enter “zero”. This is the sort of tax credit that wealthier Michiganders can avail themselves of. However, the Republicans have seen to it that this way of reducing your overall income, this tax break, is NOT available to our poorest citizens.

That’s not all that’s coming down the pike. When I spoke with Senate Minority Leader Gretchen Whitmer this week, she pointed out that Michigan pensioners are going to be shocked to see that they now owe taxes on their pensions that they never had to pay before. There was a lot of hullabaloo when that was passed but enough time has passed that many Michiganders likely have forgotten about this income tax increase on our senior citizens. Well, that memory will come flooding back when they file their 2012 taxes in the next couple of months, just like it will for the people who formerly could take advantage of the Homestead Property Tax Credit.

But you can feel better about paying all these higher taxes folks. Because, hey, they were passed by lower taxes/smaller government Republicans! And we should all be thankful that the truly wealthy folks aren’t taking nearly as big a tax hit as you are. And our state’s businesses? Well, they are laughing all the way to the bank.

I’m sure they’ll all thank the little people who made it all possible.