A successful myth, of course, but a myth nonetheless

A study by the Center on Budget and Policy Priorities released last week shows that the claim by Republicans that allowing the Bush tax cuts to expire on the wealthiest among would harm small businesses is a myth. In fact, only 2.5% of small business owners are in the top two tax rates and only 0.5% of them are millionaires.

A study by the Center on Budget and Policy Priorities released last week shows that the claim by Republicans that allowing the Bush tax cuts to expire on the wealthiest among would harm small businesses is a myth. In fact, only 2.5% of small business owners are in the top two tax rates and only 0.5% of them are millionaires.

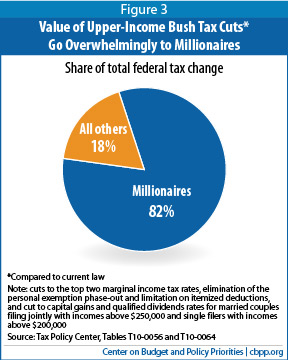

Very few small business owners face the top two tax rates. The Treasury study shows that only 2.5 percent of small business owners, and 7.9 percent of filers with any income from small businesses that employ people, face the top two tax rates. Only 0.5 percent of small business owners, and 3.3 percent of filers with any income from small businesses that employ people, make $1 million or more per year. {…}Extending the tax cuts on incomes in excess of $250,000 would add nearly $1 trillion to deficits over 2013 to 2022, but benefit only about the highest-income 2 percent of households. The biggest benefits would flow to the very highest-income people… more than 80 percent of the value of the upper-income tax cuts would go to people who make more than $1 million a year.

As discussed above, very few of the high-income taxpayers who benefit from the upper-income tax cuts are in fact “small businesses” in the way the term is commonly understood. Moreover, there is no good evidence that cutting the taxes of small business owners is an effective way to boost hiring or growth in either the short run or the long run.

Policymakers ought not let myths and lobbyists’ slogans regarding high-income taxpayers and small businesses drive them toward a costly policy that would add heavily to deficits while delivering little economic benefit.

It’s an important study and one that I commend your attention to. It dispels many of the lies and myths perpetrated by the wealthy elite in America that are so desperate to keep their massive tax breaks, a gift to them from George W. Bush, that they are perfectly willing to take away from our poorest citizens or to continue contributing to our mounting national debt in order to pay for it.

Take some time to peruse this very easy-to-read study. It will give you the ammunition you need to argue with tea partiers and other conservatives who will vote against their own self-interest to make sure the very rich among us continue to benefit, even as they themselves are hit hard in order for it to happen.

There’s a great quote from John Steinbeck that’s apropos of today’s debate about our tax policy:

Socialism never took root in America because the poor see themselves not as an exploited proletariat, but as temporarily embarrassed millionaires.

This isn’t a debate about becoming a socialist country, of course, no matter what the far right would argue. It’s about those that benefit the most from society paying their fair share. But the truly exploited among us have been effectively convinced that any effort to ask our super-rich to pay a fraction more in taxes is somehow going to hurt them.

It’s good marketing, to be sure. But it’s terrible tax policy for a country as in debt as ours.

(Fun Eclectafact: I’m such a politics nerd that I actually own a Center on Budget and Policy Priorities t-shirt.)