They are counting on us to be too stupid or distracted to care

If there is one thing that you could count on hearing in the stump speeches of Michigan Republicans during the 2010 midterm campaign it was that they were going to lower your taxes, by God. Smaller government funded by fewer taxes was their recipe for success.

If there is one thing that you could count on hearing in the stump speeches of Michigan Republicans during the 2010 midterm campaign it was that they were going to lower your taxes, by God. Smaller government funded by fewer taxes was their recipe for success.

Of course, they immediately got to work NOT lowering taxes and passed the Emergency Manager Law, started a campaign to destroy all unions that is well into its third year and have continued to attack women’s reproductive rights and freedoms with an anti-woman zeal not seen since the days of New England witch trials.

But today, April 15th — Tax Day — it’s worth taking a moment to pause and realize that not only did they not lower our taxes, for more than half of the people living, working and trying to get by in Michigan, they actually RAISED taxes.

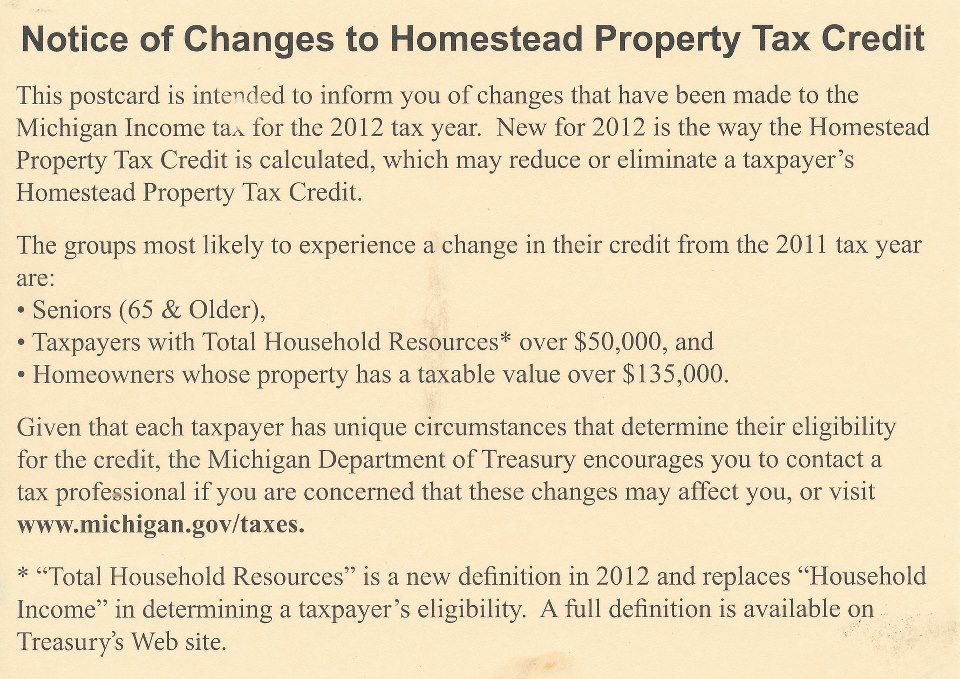

Remember back in December when they sent these cards out, letting people know just how screwed they were going to be when they did their taxes?

Image provided by Rochelle Noel, used with permission

Notice of Changes to Homestead Property Tax Credit

This postcard is intended to inform you of changes that have been made to the Michigan Income tax for the 2012 tax year. New for 2012 is the way the Homestead Property Tax Credit is calculated, which may reduce or eliminate a taxpayer’s Homestead Property Tax Credit.The groups most likely to experience a change in their credit from the 2011 tax year are:

- Seniors (65 and older)

- Taxpayers with Total Household Resources* over $50,000

- Homeowners whose property has a taxable value over $135,000

Given that each taxpayer has unique circumstances that determine their eligibility for the credit, the Michigan Department of Treasury encourages you to contact a tax professional if you are concerned that these changes may affect you, or visit www.michigan.gov/taxes.

* “Total Household Resources” is a new definition in 2012 and replaces in determining a taxpayer’s eligibility. A full definition is available on the Treasury’s Web site.

As usual, I waited to do my taxes until yesterday. Just like countless other Michiganders, not only do I have less money in my pocket thanks to their new tax code, I actually have to send in a MUCH larger check than I ever have in the past. And I’m doing fairly well. It’s Michigan’s poor people that are hit the hardest by the tax increases. Here’s a bit from a Detroit Free Press piece on this that explains why:

Some major income tax changes approved 21 months ago by Gov. Rick Snyder and lawmakers are just now starting to hit Michigan taxpayers filing their state tax returns.One of the most significant adjustments: Homeowners and renters used to qualify for a credit if their household income was no more than $82,650 a year. Now they don’t get it unless their total household resources are $50,000 or less and their home’s taxable value (roughly half the market value) is no more than $135,000.

That will affect about 400,000 returns.

The child deduction is gone. So are special exemptions for seniors and those getting at least half their income from unemployment checks.

A refundable credit for low-income workers was reduced, impacting about 783,000 returns. Eliminated are state credits for city income taxes, college tuition, adoptions and donations to universities, public radio and TV stations, food banks and homeless shelters.

Add it up and about half of all Michigan filers are seeing a considerable tax increase ahead of the April 15 deadline, said Terry Conley, a tax partner at Grant Thornton in Southfield.

“There’s quite a bit of surprise, quite a level of frustration with the increases,” he said. “There’s going to be some unhappy campers out there. It’s relatively common for radical tax changes to be enacted and not really be understood until it’s time for returns to be filed.”

And don’t forget: senior citizens with pensions are now going to see those taxed, as well.

Thankfully, jobs are just flooding into Michigan and we’re awash in them thanks to the nearly $2 billion in tax cuts for corporations. Oh, wait. Actually we’re still 45th in unemployment in the country. Only five states have a higher unemployment rate.

Gee, this all working out just so well, isn’t it?