Another massive transfer of wealth to the richest just when we need it least

Whenever people point out that Ronald Reagan would be too liberal for today’s Republican Party, I get the point.

He backed immigration reform and gun safety restrictions after leaving the White House. Reagan also recognized that his ability to slash government was limited by a Democratic House and a middle class very attached to the promises of Medicare, Social Security and even Medicaid. So he pursued the real conservative plan for gutting government through destroying the tax base and appointing Supreme Court Justices who will (eventually) deliver death blows to programs no national politician can ever back and expect to be re-elected.

Reagan will always be a conservative icon because he achieved the most prized goal of the conservative movement — cutting the top tax rate from 70 percent to 28 percent by the end of his term.

He so fundamentally shifted our tax debate that even getting rid of tax breaks for the richest is nearly impossible — let alone raising rates or creating new brackets for the richest.

The Reagan consensus that taxes on the rich should be low persists even though economic growth was both stronger and more widespread in the era when rates on the rich were much higher.

Not only is there no economic argument for low taxes on the rich, there are multiple arguments that suggest huge societal costs for these massive transfers of wealth to the people who need it the least.

Jeff Spross explained this last tax day:

The distribution of incomes, jobs, and capital affects society on every level — social, political, and moral. Rampant inequality and an income ladder spiraling into the heavens results in fractured communities; warps our political system; degrades our perspective, empathy, and moral capacity; transforms life into a grinding treadmill of perpetual striving even for the well-off; and pretty much makes society worse in just about every conceivable respect.

Earlier this month we got news that 20 people own more wealth that the bottom half of all Americans, about 152 million people.

Billionaire Nick Hanauer asked his fellow capitalists to put these numbers in a spreadsheet and extrapolate out a few decades.

“At that point you don’t have a capitalist democracy anymore,” he told Barry Ritholtz. “You have some kind of feudal system.”

So what are Republican candidates proposing to do about the crisis of inequality that has gutted the spending power of everyone but the richest Americans?

They want to make it much worse.

A new analysis of Donald Trump’s tax plan shows that it would explode the debt by $9.5 trillion, more than 7 times the cost of the George W. Bush tax breaks, which were passed when the deficit was in surplus.

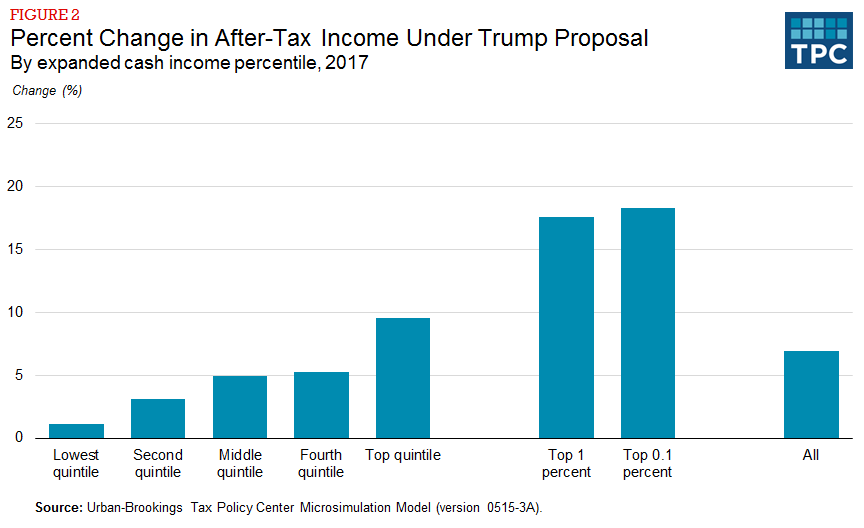

And the biggest benefits go to the richest people who already own most of America’s wealth.

It would boost the richest’s take-home income by 20 percent with “those in the top 0.1 percent (who make $3.7 million or more) getting an average tax cut of more than $1.3 million,” the Tax Policy Center’s Howard Gleckman wrote.

Trump has said he would also expand defense spending and maintain Social Security and Medicare. Like much of what he says, this makes no sense.

“Just in 2025 alone, the Tax Policy Center estimates that federal spending would need to be cut by at least 20%,” CNN reported. “That would amount to more than 100% of defense spending, or 82% of domestic program spending, or 41% of Medicare and Social Security spending”

Trump like Reagan and Bush before him will argue that the tax breaks will pay for themselves — when they won’t. He’d probably go further and argue that they’ll more than pay for themselves.

And Trump is not alone. All of the Republican candidates are offering tax plans that are “basically insane.”

“Just like a carbon tax could ward off climate change, a well-designed tax system could ward off oligarchy and social decay,” Spross wrote.

And a tax system designed by these Republican candidates — like the tax system designed by Reagan — will speed our decline to feudalism in the name of making us great again.

[Image by Gage Skidmore | Flickr]