Saving big money was just the beginning of the good news.

In November 2013, I struck gold — literally. I found a Gold plan on the Affordable Care Act (ACA) Marketplace that saves me $900 a month on my premiums for the same coverage.

In November 2013, I struck gold — literally. I found a Gold plan on the Affordable Care Act (ACA) Marketplace that saves me $900 a month on my premiums for the same coverage.

With 2015 open enrollment starting on November 15th, it’s a good time to take a look at how things turned out for me.

Did I pick the right plan for my needs?

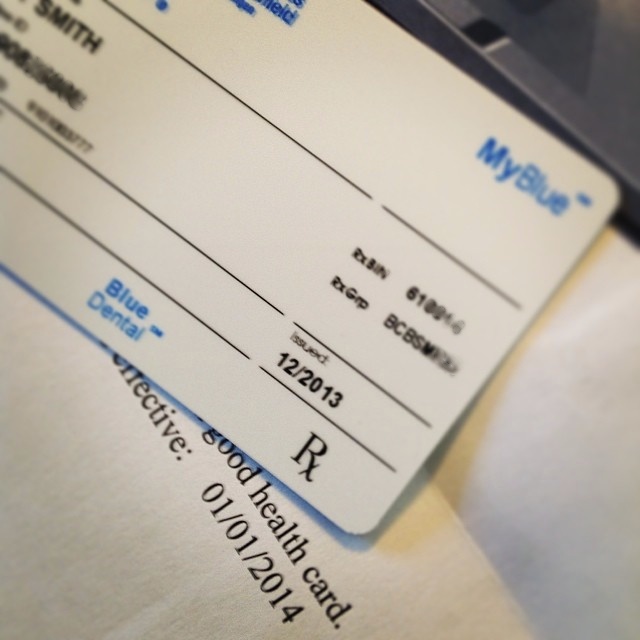

I wanted to choose a plan that mirrored the one I had before so I could make an apples-to-apples comparison. As it turns out, I bought a plan that was nearly identical. Both Blue Cross Blue Shield of Michigan (BCBSM) and my pharmacist confirmed that not long after my coverage had kicked in.

My annual premium for the same coverage dropped from $1,400 a month to $530 a month, and that’s without a subsidy. Many folks would pay less for the same plan with financial assistance available under the ACA.

I realize that not everyone can afford $530 a month for insurance, but it was the right choice for me. I have diabetes, and the cost of my insulin alone would be more than that every month without insurance. I can’t skip that medication without putting my life at risk. The plan also includes all my doctors, which is important to me.

Many people with chronic conditions may want to consider a plan with a higher premium. My costs are predictable from month to month. My deductible is only $150 a year and my out-of-pocket maximum is $5,100. I pay a $15 co-pay for most prescriptions, and sometimes less. People without a chronic health condition, especially young adults, may prefer a plan that has a lower premium and a higher deductible.

Did I get hit with higher costs along the way?

Under my new plan, most of my out-of-pocket costs are the same — and some are less than they were before. Only two costs increased, which I knew would be the case when I chose the plan.

The first is the cost of my insulin. I take newer types of insulin, which were placed in a higher cost tier by BCBSM than the other medications I take. (This is a trend seen across many insurers when it comes to covering chronic conditions.) I pay about $100 every three months instead of the $10 I paid in the past. I’m not thrilled, but my lower premium makes up for it.

The second is my cost to visit specialists, which has gone up from about $10 to $30 per visit. But these are doctors I only see once or twice a year, so it’s not a huge hit.

Plus, I didn’t have to pay a penny extra for my annual physical, nor will I pay extra for my routine mammogram later this year. These are among the preventive services covered for everyone at no extra cost under the ACA. So the higher cost for specialists is pretty much a wash.

Was my coverage there when I needed it?

In at least one case, I saved really big this year because of the insurance I chose. I travel a fair amount, so I paid $30 a month extra for coverage that included a nationwide network, plus vision and dental coverage.

That coverage was put to the test when I had to visit the emergency room during a business trip. Fortunately, it turned out to be nothing serious, but my symptoms were scary enough that I didn’t hesitate to seek emergency care. The total bill for 15 hours in the hospital was $9,000. My share of the bill was less than $800, because the hospital was in-network. Even if it had been out-of-network, I would only have owed about $2,500 — the balance remaining at the time on my out-of-pocket maximum for the year. I realize that’s not a small amount of money, but it’s better than it would have been without coverage.

Something else I’ve noticed? Customer service from BCBSM is a thousand times better. With my old plan, it was like talking to a brick wall whenever I had a question or a problem. With my ACA-compliant plan, I have had nothing but excellent customer service. Sure, this could be due to restructuring at BCBSM but I think the fact that BCBSM is no longer the only game in town for people with pre-existing conditions, which increases competitiveness, is a factor.

What will I do when it’s time to renew?

Healthcare.gov has posted estimated 2015 rates for Marketplace plans, and my current plan’s premium will increase from $530 to $589 per month. Do I love the increase? Of course not, but it’s less than the increases of more than $100 a month I was seeing for years before the ACA, which has controls in place to help prevent huge year-over-year increases by insurers.

Healthcare.gov has posted estimated 2015 rates for Marketplace plans, and my current plan’s premium will increase from $530 to $589 per month. Do I love the increase? Of course not, but it’s less than the increases of more than $100 a month I was seeing for years before the ACA, which has controls in place to help prevent huge year-over-year increases by insurers.

I could shop around for a less expensive plan — I saw some good options on the Marketplace, and there are more of them this year than there were in 2013 — but I’m sticking with what I’ve got. Some of my dental benefits only kick in after 12 months, and it’s worth it to me to get what I’ve waited for because of some upcoming dental work. For 2016, who knows? I’ll do another comparison based on my needs when the time comes.

To recap: I kept all my doctors, I’m paying less overall — about $9,000 less per year total — I get better customer service and my insurance was there when I needed it most. My costs have been predictable and any surprises I’ve had have been good ones.

Part of the reason I’ve fared so well is that I did my homework before picking a plan. There’s no reason everyone can’t do the same and find coverage that suits their needs and budget. It’s worth taking a couple hours to consider all the pros and cons of the plans that may be right for you. I know there are people who think they’re stuck paying more under the ACA, but I honestly think many of them simply didn’t do their research.

Healthcare.gov is easier to navigate than ever, and you can start browsing before you begin the process to apply or renew. Plus, help is available online, over the phone or in person if you have questions. The information is all on the website.

Open enrollment runs from November 15 to February 15, 2015. You need to be enrolled by December 15 for coverage to kick in January 1, 2015.

Do you have an ACA success story to share? Contact me HERE if you’re interested in being profiled in a future post.