Yesterday, Gov. Rick Snyder participated in a one-hour call-in show on Michigan Radio. The show was hosted by the incomparable Rick Pluta who did an excellent job of selecting questions from the Michigan Radio Facebook page, Twitter, emails, and actual phone calls. When Gov. Snyder tried to weasel out of answering a question, Pluta did a good job of pushing back.

You can listen to the full interview here:

Here are some the more interesting things Gov. Snyder said during his interview:

Regarding the Education Achievement Authority as the “best option” for poor-performing schools in Detroit:

The traditional system did NOT work with respect to these kids. So, isn’t it important to try to come up with innovative ideas? So, we actually looked at best practices. We had a lot of help from experts around the country, some of the leading educational people and organizations. The Educational [sic] Achievement Authority is really taking on two or three things that I think are critically important. One, they’re modeling the concept of more year-round school and I think the evidence is really strong that year-round schools, particularly for students who are really challenged, that have a difficult environment, they can better in that environment. The other one is the concept of “Student Centered Learning”, really empowering the students. And so that takes some time to show up…It’s one of the foremost ideas of the Educational [sic] Achievement Authority. It is working… It takes some time … You don’t make up several grades in one year, it takes multiple years. The real question is has their been student growth from the last time they were really gone through tested or assessed in some fashion, and they’re showing results there.

While year-round schooling is a potentially good concept, as I told a reporter during an interview for an NBC News piece on longer school years, it is only a good solution when the programs is working well for kids:

“I don’t necessarily have a problem with year-round schools; I just don’t think that in and of itself is a solution,” said Chris Savage, community activist who has testified against the EAA in the state legislature and author of the Eclectablog, which has served as a watchdog to state control. “A year-round school in a sound program is a great idea.… They need to get their program in order.”

And the fact is, the EAA simply is NOT improving the outcomes for these schools. When Professor Tom Pedroni analyzed the data, claims being made by the EAA that they had advanced kids as much as two grade levels in a single year were found to be, simply put, lies.

When Gov. Snyder talks about bringing “some of the leading educational people and organizations”, he’s talking about groups like the Broad Foundation, the Bill and Melinda Gates foundation, and other philanthropic groups that are spending enormous amounts of money to essentially kill off our public school system in favor of for-profit charters and other education models that involve funneling taxpayer dollars into the coffers of for-profit corporations.

With regard to Student Centered Learning, while the concept is worth exploring, the way that it has played out in the EAA has been an utter failure. The teachers and students in the EAA are essentially the beta testers for a software package that often doesn’t work, the schools didn’t have enough computers for the kids to use it, and it was basically an empty shell with no curriculum, forcing teachers to add their own curriculum when a large percentage of them were first-year teachers.

Gov. Snyder needs to convince voters that the EAA is some sort of a success story but the truth, as has been well-documented at this site, is that it has been an utter failure and needs to be ended now.

Finally, with regard to the idea that the success of the EAA isn’t going to “take some time to show up” flies in the face of the claims made by the administrators of the EAA itself. It is also highly reminiscent of his latest ad where he tells us that our state’s economy is on the “road to recovery” and that “you might not feel it yet, but you will soon.”

Regarding the taxing of pensions:

Actually, that’s a mistatement when it says ‘seniors’, if you look how the system works. It was really about, essentially, removing a exclusion on pension income. So, the first thing we did as part of that process is say, let’s look at our system. And what we did is say if you have certain kinds of retirement income, you pay no Michigan tax, regardless of your age. So, we had many people retiring at 40 or 50 not paying any tax for the rest of their lives on that income. And, if you think about it, is that really a fair answer with respect to other situations where you have seniors still having to work that were paying Michigan income tax? Or the fact that, in many respects…when I was campaigning, everyone said, “We want to keep our kids in Michigan.” If you make it so retirement income isn’t taxed, you’re shifting your tax burden essentially to your kids and say, “We want you to carry us.” And that’s not a fair answer. So, what do you do? We made modifications and the first part of it is is we grandfathered in all our seniors. We defined seniors as 67 and older. So none of the tax law changed with respect to retirement income for anyone in that category.The next piece is we put a transition in for people between 60 and 67. So we gave them a special exemption of up to $40,000 for a married couple for that kind income and in addition to the transition so they had a much more favorable case. So, the people that really get affected by this are people before they’re seniors in terms of their retirement income, or if they have high retirement income. And, what we did is, instead of having that, we put in an exemption for ALL seniors, of up to $40,000 for a married couple, for ANY kind of income. So, what we did is we now made it fairer for those people working, who had to work. They’re not going to pay Michigan income tax now where they used to have to. And now it’s fairer between people who have retirement income and people who have working income. They only seniors that really will pay is if you have pension income, of income well above $40,000. Once you get above $40,000, you can be affected by it. Or if you’re younger and you’re not a senior. So that was part of this is let’s make a fairer long-term system that really makes it, for the income working people, the people still having to work, they have a much fairer situation. It’s still one of the top ten most generous schemes in the country.

It’s hard to know what to say about this other than that there are plenty of retirement age folks who beg to differ about this particular claim that the new tax on their pensions is somehow not a tax. It brings to mind the adage, “Don’t pee on my shoe and then tell me that it’s raining.” Suggesting that taking care of our senior citizens by not taxing their pensions, something that they counted on, is somehow “carrying” them and unfair is truly insulting given that these are people who worked their entire lives, contributing to society, and now want to retire with a little bit of money and a little bit of dignity. Governor Snyder acts as if $40,000 a year for a married couple is somehow a huge amount of money but we all know this is hardly the case and a large number of seniors whose pensions were not taxed in the past will see a tax increase. Period.

Quit peeing on their shoes, Governor.

Regarding cutting taxes on corporations and paying for it by raising taxes on everyone else:

We simplified our tax code in a lot of ways. Let me talk about the issue about business benefiting because, again, that’s another misinformation piece out, because a lot of times people like to characterize this as “Big Business” winning. Big Business did not get a tax benefit from the tax changes we made. That didn’t happen at all and, in fact, we changed…the simple facts are is the corporate tax rate is 6%. The individual tax rate is 4.25%. And I wiped out most of the tax credits in the corporate tax code. One of the few credits remaining is for small business. What we did was make a fairer tax system because it was really small and medium-sized businesses, the people that create jobs – we were putting a huge burden on their backs. Think about this: they were paying the Michigan income tax because that flows through. So, we pay taxes on our wages – I pay tax on my salary as governor – small business people were paying on the income of their business but then we said let’s stick ’em with another tax. We were taxing them more than what we were paying. That’s not a fair answer, particularly when they’re the job creators. So the tax reform we did was to essentially say let’s tax away that second tax and now create a fair system that we’re simply asking them to pay the tax rate the same way you and I pay on our salary. And that helps generate more jobs and that’s the fair answer. So, that’s the tax reform that really happened. It wasn’t all Big Business. Again, I wiped out their credits, they have a higher tax rate than individuals. That wasn’t a big win. […] So, we got rid of a dumb tax and replaced it with a clear, simple system that actually requires good, higher payments, in some ways, from corporations, larger corporations, and, at the same time, makes it fairer for small and medium-sized businesses.

This is the classic “Straw Man Argument” where Snyder mischaracterizes the argument and then shoots down the mischaracterization. Few people are talking about “Big Business”. We’re talking about the plain and simple fact that corporations in this state are enjoying a nearly $2 billion tax break while money has been pulled from our classrooms, the middle class and poor are seeing their tax burden increased, and our senior citizens are now paying a tax on their pension that they didn’t pay before. It’s important to know that the definition of a “small business” probably isn’t what you think it is. While it includes the local “mom & pop” store on the corner, it also includes businesses with as many as 1,500 employees and making as much as $38 million a year. And that’s just for a so-called “small business”. For example, an oil refinery or aircraft manufacturer with 1,500 employees is considered a “small business”. An oil and gas support corporation making $38.5 million a year? That’s a “small business”.

The “taxed twice” argument was shot down extremely well in a must-read report by the Michigan League for Human Services:

The double taxation concern is flawed because it is only applied to business and not to individuals. For example, personal income is taxed once, through the personal income tax, and again, throught the sales tax on purchases. In fact, the double taxation for individuals was made worse when the recent tax changes eliminated the city income tax credit so that individuals pay taxes on the same income twice. The other argument in favor of taxing businesses is that they use government services such as police and fire services for their building, as a separate entity from individuals, and these benefits should be paid for through taxes.

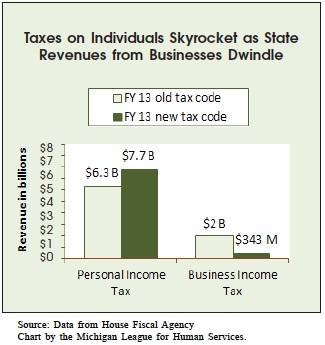

That same report shows the impact of the business tax cuts:

This self-created deficit came about because nearly 100,000 businesses no longer pay the Michigan Business Tax.

By the way, if “Big Business” was feeling so much additional tax pain under this new tax scheme, you can be quite sure you would have heard from them about it. You can trust me when I say they tend not to stay quiet about that sort of thing.

In the final analysis, this isn’t about “Big Business”, it’s about a policy that says corporations should be taxed less, individuals should be taxed more, and this will create jobs. Three years later we still have the third highest unemployment rate in the country so apparently all of that tax savings hasn’t translated into businesses doing more hiring, after all.

Please, Governor, quit peeing on our shoes.

Regarding increasing the State Earned Income Tax Credit for poor working families:

There’s one huge challenge on that. That was something that we did scale back to some degree. It’s really a federal program. The way our program works in Michigan is we simply take a percent of whatever that federal credit is and we were paying that. It used to be 20% and now it’s 6%. Some people have suggested bringing that back to some degree. And one of the challenges to do that is is if you look at the Internal Revenue Service themselves, the Auditor General for the IRS has basically come out and issued a report that says over 20% of the payments under this program are improper. So, one of the real questions is should we be looking to reinvest in a program where the federal government themselves comes out and says more than 20% of those payments are improper. That’s hard to justify.

Basically, what Gov. Snyder is saying here is there’s waste in a federal program so every low-income, working Michigander must pay the price for that. This self-proclaimed problem solving CEO/accountant isn’t clever enough to find a way to solve that particular problem so the tax cut must be slashed by 60% and poor Michiganders can just deal with it.

That’s insulting and offensive and Gov. Snyder should be held accountable for that astonishing comment.

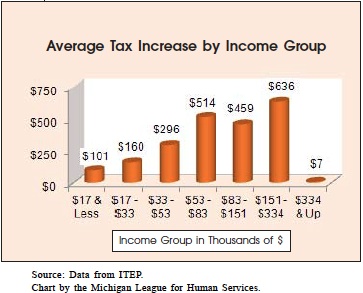

What is shocking is how easy Gov. Snyder’s budget goes on upper income Michiganders and how astonishingly HARD it hits lower income residents. Take a look at the average tax increase broken down by income group, again from the MLHS report:

When you look at the total state and local taxes as a percentage of income of those making $334,000 or more per year vs. those making $17,000 year or less, the poorest people pay 1000 times more than those at the top of the food chain. The poorest Michiganders pay 1.0% of their income vs. 0.001% for the top earners.

Gov. Snyder can’t justify keeping the Earned Income Tax Credit at 20% for the working poor but somehow he CAN justify that.

Regarding restoring the Emergency Manager Law after voters voted it down:

Actually, what we did was look at some of the key issues and concerns that were clear about the public vote. That got to the point of how long someone was in the position and did the community have other options to choose. So, we modified the law to take those into account. So, what we did was look at, okay, here are the issues, here are some of the primary criticisms and put that into account of having a new law to go forward.

Right, right. You “fixed” the Emergency Manager law after voters weighed in at the ballot box. The one thing you forgot to “fix”, Governor, is the whole “taking away democracy” part. Don’t insult our intelligence by suggesting that the our vote to overturn the Emergency Manager law was a primer on how to make it better. That law is and was an affront to our nation’s bedrock foundation of democracy and no amount of obfuscation on your part changes that. You thwarted the will of the people and you know it.

Marriage equality:

As a practical matter, the courts are really going to decide this matter. I’ve said that it’s in the court system and they’re going through that process. It was something decided by the people in Michigan’s constitution several years ago. They voted on the definition of marriage being between a man and woman. And, as a practical matter, that’s Michigan’s constitution. So, now we’re going through the court system to see what the answer is. And the Attorney General is the one who is primarily pursuing this and he’s doing the appropriate action of saying that’s what the constitution says so he needs to defend the constitution of the State of Michigan.

Michigan’s ban on same-sex marriage didn’t happen “a few years ago”. It happened a decade ago in 2004. Since then, a plurality of Michigan citizens now support marriage equality in our state. As far as Attorney General Bill Schuette wasting millions of our tax dollars on defending this bigoted ban, the fact is the court HAS weighed in on this and found the ban unconstitutional. It was a choice by Schuette to continue fighting it, one he could have chosen NOT to fight after a federal judge had ruled.

When this issue is resolved once and for all, Gov. Snyder and AG Schuette will be seen as being on the wrong side of the issue, supporting homophobic bigots over the will of the majority of citizens of Michigan.

Regarding the expansion of the Elliott-Larsen Civil Rights Act to protect members of the LGBT community:

I’ve made it clear that I don’t believe in discrimination and I think it would be appropriate for the legislature, at some point, to take up this discussion and I’ve been encouraging them to take up that discussion of Elliott-Larsen. […] Let’s have a good dialogue, a good discussion before the legislature and, again, that’s where the forum should be and that’s where we can have public hearings. We can have a great public dialogue on it and I’ve been encouraging them. I think the Speaker actually previously had sent signs that he was interested in the topic at some point. It’s just now a question of, you know, we’re in an election season and then there’s the lame duck session.

This is what passes for “leadership” from our CEO/accountant governor: punting a contentious issue to the courts and the legislature. When he was asked by Rick Pluta if he would sign a bill that extends civil rights protections to the LGBT community, Gov. Snyder responded, “Well, again, I don’t do hypotheticals…I wait until a bill gets to my desk then I do my analysis.”

This isn’t leadership, it’s cowardice.

On whether oil drilling in residential areas is appropriate:

Well, it’s a balancing act. When you get into extremely urbanized areas, again, residential neighborhoods. It’s really how do you do it in a way that you have respect for the number of people living there. In many cases in Michigan, people are actually excited to see it because it brings in good revenue to the land owners and the people living in that area. And, so, again, how do we strike that right balance when you get into very populated areas.

Republicans LOVE to talk about local control but, apparently, when oil and gas profits are on the line, we have to find “the right balance” between the greed of Big Oil companies and the health and safety of our residents and the environment. This is another issue on which Gov. Snyder is going to be seen on the wrong side of.

On leadership in addressing global climate change:

One of the controversies you get it is there global warming and what caused it. What I was going to say is that it’s clear that the volatility in the weather and the challenges are more.

BREAKING! Governor Rick Snyder is a climate change denier!

On signing Right to Work into law after saying it was “not on his agenda”:

It was (because of) a change in circumstance that Proposal 2 went on the ballot. Basically I met with labor and management during the summer and Proposal 2 was about putting collective bargaining in Michigan’s constitution. That would have destroyed Michigan’s economy, in my view. It was a devastating proposal. And I suggested to them, I said my real concern here is if you start on this path on collective bargaining, you’re going to highlight the right to work issue. That you’re going to put both of these issues on the table. And, in fact, I asked labor, in particular, not to go ahead with their petition drive. It’s not payback. It’s actually why I walked through it ahead of time. I didn’t threaten, I just said my concern is is if this goes forward, this is a likely consequence. I don’t think anyone disagreed with that. Everyone understood that could be a consequence and so there’s no threat. I don’t threaten people. I just do my job. I’m there to solve problems. I don’t believe in fighting with people.So, that was a case where it went ahead and, again, it got defeated – appropriately defeated – and right to work was a consequence. And right to work is not a bad answer. It’s a good answer. It’s standing up for Michigan workers. They should have the freedom to choose. It’s about representing Michigan people and it’s helped our business development pipeline in this state. We’ve got a lot more companies looking to build and stay in Michigan because of that.

Gov. Snyder just redefined “threatening someone” as “walking them through it ahead of time”. Make no mistake, when Snyder “walked labor through” how things were going to play out ahead of time, it was clearly a threat. He made it clear that, if they pursued Prop 2, Snyder and his business pals like Dick DeVos would punish them by making Michigan a Right to Work state. And, when labor organizations moved forward with Prop 2, they made good on their threats. Period. You can whitewash the payback with fun phrases like “walking them through it ahead of time” but you threatened them, plain and simple.

[Caricature by DonkeyHotey from photos by Anne C. Savage for Eclectablog]