Warren Mayor Jim Fouts plans to file a lawsuit to overturn Proposal 1, approved by voters in Tuesday’s primary. The ballot initiative eliminates the Personal Property Tax which taxes businesses for equipment that they own, giving Michigan businesses a half billion dollar tax break on top of the $1 billion cut in corporate taxes passed in 2011.

Warren Mayor Jim Fouts plans to file a lawsuit to overturn Proposal 1, approved by voters in Tuesday’s primary. The ballot initiative eliminates the Personal Property Tax which taxes businesses for equipment that they own, giving Michigan businesses a half billion dollar tax break on top of the $1 billion cut in corporate taxes passed in 2011.

Fouts said the lawsuit will contend that the wording of the ballot proposal violated state law. He called the wording “confusing,” “one-sided,” “prejudiced” and “blatantly unlawful and fraudulent,” in a news release today announcing that he has directed the city attorney to file the lawsuit Friday in the Michigan Court of Claims.“State of Michigan law is crystal-clear prohibiting slanted ballot language for any proposal,” he said, adding that he was the only elected official in Michigan to oppose the question.

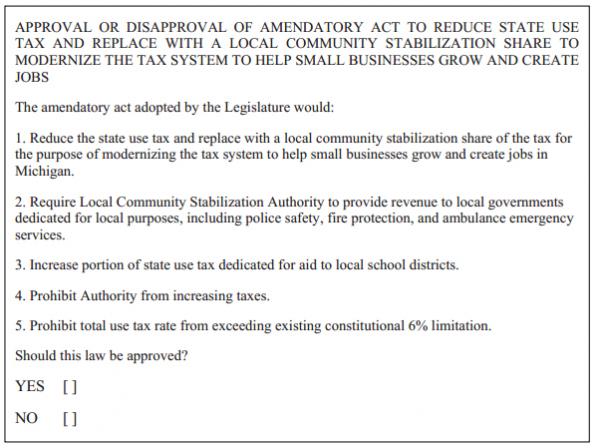

The language of the proposal didn’t actually even mention that this was a huge tax cut for businesses and is clearly slanted to encourage a yes vote:

More from Mayor Fouts:

Fouts said wording in the proposal was a “sales pitch appealing to all voters.” He cited such phrases as “helping small businesses grow and create jobs,” “modernize the tax system,” “police safety, fire protection, and ambulance emergency services,” “aid to local school districts” and “prohibiting the authority from increasing taxes”.Fouts said the proposal purposely avoided using works like “tax cuts for large manufacturers” because that would have caused a “voter backlash” diminishing the chances for approval.

“But tax breaks for large manufacturers is the essence of the proposal with minimal tax breaks for small businesses,” Fouts said. “And state legislators conveniently left out the use tax increase in the proposal’s language.”

Fouts is also filing a complaint regarding state legislators sending our promotional materials for Proposal 1 at taxpayers expense, saying that they should reimburse the state for “that abuse”.

Godspeed, Mayor Fouts. I wish you well on this.