Michigan voters are being asked to vote on one statewide ballot proposal tomorrow, one that will eliminate the Personal Property Tax (PPT) imposed on equipment a business owns. Businesses hate this tax because it is essentially double taxation. They pay taxes when they buy equipment and then pay the PPT every year on the same equipment. This tends to disincentivize investment in new equipment, hindering growth and expansion.

However, the PPT also funds the operations of many local governments, including fire, public safety, and all the other services provided by them. There are at least 30 local governments for which the PPT provides 30% or more of their operating revenues.

The initial attempts to kill the PPT created a hue and cry from local municipalities, many of which faced catastrophic holes in their budget if those revenues went away. In response, our state lawmakers came up with a complicated system (involving ten bills) for eliminating the PPT while ensuring that local governments wouldn’t face this massive loss in revenue.

Proponents of the proposal – and there are many – say it eliminates the PPT “without raising taxes on anyone!” This is true, at least in the short term. However, this is a truly zero sum game so this massive tax break is paid for in other ways with our general fund taking a huge hit. And, if future legislators do what legislators in the past have done and go back on their plans to protect local municipalities from a huge loss in tax revenues, taxes may very well rise at the local level in the future in order to keep their governments solvent and out of the clutches of a state-imposed Emergency Manager.

It’s worth noting that proponents claim that some of the hole being blown in the state’s general fund is being made up for by the expiration on tax credits for things like vehicle battery manufacturing. However, these are phase outs that are already in place and will go forward whether Proposal 1 is passed or not.

The Citizens Research Council of Michigan (CRC), which has done the most extensive (and excellent) analysis of the Proposal (HERE), describes the situation this way:

The package…comes at a price. The reimbursement provisions contained in the package are not cheap, and the State of Michigan will forego an increasing amount of its general fund/general purpose revenue in future years in order to hold local governments harmless from the PPT reforms. The net loss to GF/GP revenue rises to over $500 million by FY2025, and this foregone revenue also means foregone opportunities to use this revenue to meet other budget priorities.

At the end of the day, voters need to decide (a) if the shift in tax revenues to give businesses – small businesses and large corporations alike – a(nother) tax break is a smart move that will improve our state business climate and (b) if the state legislature can be trusted not to change things at a later date in a way that harms local municipalities. Given their track record with things like reneging state revenue sharing – tax revenues that are returned to local communities – many are concerned that they can NOT be trusted. How that would play out is largely dependent on who we elect to the state legislature in the future.

I am highly ambivalent about this Proposal. Many individuals and groups that I trust are on opposite sides of this issue. Like many, I’m concerned that this is basically just another tax break for businesses on top of the massive tax breaks they have already received under the Snyder administration. (The fact that Big Business is spending millions to promote passing Proposal 1 tells you just how much they are salivating over this.) On the other hand, the PPT is a flawed and inconsistent way to fund local governments and there’s little question that it has a negative impact on capital investments by businesses in Michigan.

I will be voting NO on Proposal 1. While it may be our best chance to eliminate the PPT without causing undo harm to local municipalities and schools given our current legislature, I am a hopeless optimist and believe that the complexion of our state legislature will become bluer in time as Republicans are replaced by voters who are unhappy with how they are running our state into the ground.

If we want real tax reform in this state, it must be done in a more holistic and comprehensive way. This proposal seems haphazard and piecemeal and I trust Democrats far more than our current cohort of lawmakers to do the right thing in the future. I am also distrustful of the way that the Proposal ensures local governments will be held harmless. There is a real possibility that, over time, they will be hit much harder than proponents promise. Even Democrats might find themselves in a position, as they have in the past, of having to balance the state budget on the backs of local municipalities if the economy takes another nose dive like the one we saw in 2006-2008.

That said, I admit that it’s risky. If Proposal 1 is voted down and the GOP remains in control of our state government, there is a good chance that they will simply eliminate the PPT without protecting local governments and that would be much worse.

I’m counting on our voters to restore our state government to the control of people who don’t see continuous lowering of taxes on businesses as the cure-all for all of our problems.

I share the view of my friend David Holtz:

David Holtz is a writer and a progressive activist.“I think it’s a shell game,” he says.

He’s voting “no” on Proposal 1. He says the state doesn’t need to give another tax break to businesses.

“The money has to come from somewhere and if it’s not coming from companies that are not paying the personal property tax now, eventually it’s going to have to come from somewhere else, and this Legislature has a track record of that ‘someone else’ being people like me,” he says.

Let’s take a look at this Proposal in more depth.

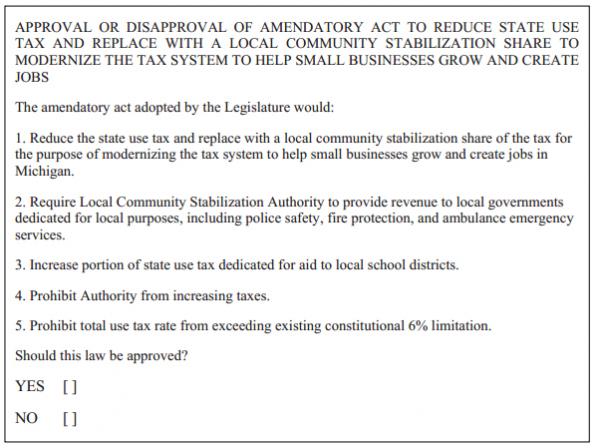

First of all, here’s the language:

As has been pointed out elsewhere, this language is a hot mess that does little to inform the voter about what it is exactly that they are voting for:

There are many problems with this language.

- It doesn’t mention the central issue the Legislature is trying to address: the phase out of the “personal property tax” on businesses.

- The language appears to show bias toward a “yes” vote – “modernize the tax system to help small businesses grow and create jobs in Michigan.”

- It contains an inaccuracy – the state’s use tax isn’t capped at 6% by the constitution. The state sales tax is.

Craig Thiehl of the Citizens Research Council lays out how this confusing and inaccurate language made its way to the ballot in his post, “Huh? Why am I Voting to Modernize the Tax System?”

The ballot proposal language was written into the bill that eliminates the PPT – Public Act 80. In other words, we’re being asked to trust that lawmakers who can’t even write a decent ballot proposal were competent enough to write a law that fixes a complex problem without doing too much harm at the local level.

In order to mitigate the distrust that voters have of legislators when it comes to not screwing over local governments after the PPT is killed off, the Proposal establishes a “local” unit of government called the Local Community Stabilization Authority (LCSA) to oversee the distribution of the revenues back to municipalities that lose funding because of it. I put the word “local” in quotation marks because this “local” government body is completely artificial. In this case, “local” literally means the entire state of Michigan (I’m not kidding.) On top of that, it’s members will consist entirely of people appointed by the Governor.

Here’s how the Proposal works (via the CRC):

To finance the reimbursement to local units of government for lost PPT revenues, Public Act 80 of 2014 calls for the state’s current use tax to be split into two distinct new taxes: (1) a local community stabilization share tax to be levied by a newly created Local Community Stabilization Authority; and (2) a state share tax which would continue to be levied by the state, with revenues used for state purposes. The local share tax is defined as a local tax, not a state tax, with revenue credited to the new authority. It is important to note, however, that Public Act 80 does not alter the total 6 percent rate charged under the use tax. The combined state share and local community stabilization share of the use tax will not exceed the 6 percent rate of the current use tax.The tax rate of the local community stabilization share would be calculated annually by the Michigan Department of Treasury to equal the rate necessary to generate specific revenue targets contained in the legislation. These targets are based on estimates of the amounts needed to reimburse local governments for PPT revenue losses. This local share component will be levied at a rate sufficient to generate $96.1 million in FY2016 and $380.6 million in FY2017, with revenue growing over time and eventually reaching $572.6 million in FY2028. After FY2028, the revenue target would be adjusted by an annual 1 percent growth factor. The state share tax rate would then be the current 6 percent use tax rate minus the calculated local community stabilization share rate.

The revenue losses due to the elimination of the PPT rise to over a half billion dollars a year by 2025. These losses come in two flavors. Again from the CRC:

In terms of the reimbursement process, these losses can be grouped into two categories:

- Revenue losses from the State Education Tax and the local 18-mill school operating levies. These

losses would be reimbursed through a deposit of revenue collected from the state share portion of the existing use tax into the state’s School Aid Fund (SAF).- Other PPT-related revenue losses from both debt and operating millages levied by local units of government. These include millages levied by counties, cities, villages, and townships as well entities such as special authorities, intermediate school districts, community college districts, and school districts that levy hold-harmless millages to finance school operations. Revenue losses in this group are reimbursed directly from the new local share tax administered by the Local Community Stabilization Share Authority.

The 2014 legislation includes a prioritization of the reimbursement to be administered by the LCSA to cover this second category of revenue losses. The legislation specifies that affected local units of government are to be first reimbursed for 100 percent of any revenue losses attributable to:

- School operating, debt, and sinking fund/recreation millages;

- Intermediate school district debt and operating millages;

- All losses to tax increment financing authorities (e.g. downtown development authorities and local development finance authorities);

- All losses attributable to the small personal property holder exemption;

- Losses associated with revenue used to finance “essential services” – defined as police, fire, and ambulance services as well as jail operations.

After these losses are reimbursed, remaining local share tax revenues would be distributed by formula to cover all remaining lost revenues (e.g. those related to services not designated as essential, losses related to community college and library district millages).

The idea that this Proposal eliminates the PPT “without raising taxes on anyone!” is true but is far from telling the whole story. That tax cut has to come from somewhere and saying that it is offset by the phasing out of existing tax credits (that will go away even if Proposal 1 fails) is disingenuous. The CRC explains the hit that will be taken to the general fund:

State general fund/general purpose (GF/GP) revenue will decline for two reasons: (1) a portion of the GF/GP revenue currently generated by the state’s use tax is redirected to the new local community stabilization share tax administered by the Local Community Stabilization Authority; and (2) additional GF/GP revenue is needed to make up for reduced State Education Tax and local school operating millage revenue that results from the PPT exemptions and that would otherwise impact the state’s School Aid Fund.

In addition to the phasing out of some existing tax credits, the hit to the general fund is offset partially by a new “assessment” (hint: it’s a tax) called the State Essential Services Assessment which was created under Public Acts 92 and 93 of 2014. Small businesses are largely exempted from this assessment so it will fall mainly on large businesses but would be considerably lower than their current PPT bill. Again, without taking the already-planned phasing out of some existing tax credits, which have nothing to do with this Proposal, the net loss to the general fund rises to over a half billion dollars by 2025.

In the final analysis, voters must decide if eliminating the PPT to benefit businesses is a smart way to spend our tax dollars that comprise the general fund. Once more from CRC:

State voters in August will be asked, in a direct sense, to vote on the proposed redirection of the state’s existing use tax revenue to help facilitate the reimbursement to local governments of lost PPT revenues. But again, the vote has much broader implications as a rejection of the ballot measure effectively repeals the entire set of reforms, essentially re-establishing the imposition of the personal property tax on businesses and canceling the need for the local reimbursement. Valid arguments have been advanced by supporters of the PPT repeal that the reforms will enhance business competitiveness and encourage additional private sector investment. Voters will need to weigh these arguments against their own judgments as to the potential value of other possible budget and tax reforms that could be achieved with the state GF/GP resources that will otherwise be invested to facilitate the PPT reforms.

As I have said, I am voting NO on Proposal 1. If lawmakers want to get rid of the PPT, that’s fine. But to do so requires a much more comprehensive tax reform plan than this haphazard one. And, at the end of the day, businesses in Michigan are already enjoying massive tax breaks thanks to Republicans in charge of our government and we’ve seen very little to show for it. In fact, we still have the third highest unemployment rate in the USA. It’s hard to see how even more tax breaks are going to have a discernible impact.

UPDATE: There’s one more reason to vote NO on Proposal 1: GOP threats to screw over municipalities if voters don’t do as they are told. More on that HERE.

[CC graphic by Mike Licht, NotionsCapital.com | Flickr]