MORE THAN HALF OF US NOW PAY HIGHER TAXES THANKS TO THE GOP AND YES I’M SHOUTING!

A little over two years ago, I wrote a cautionary post titled “The tax timebomb that explodes in Michigan in 2012 is MUCH worse than you thought”. In it, I explained how the Republican budget passed in the first year after the 2010 midterm election annihilation of Democrats and signed into law by Governor Rick Snyder created a massive shift of taxation from the wealthy and from corporations onto the poor and middle class. Here’s a bit of that post:

A little over two years ago, I wrote a cautionary post titled “The tax timebomb that explodes in Michigan in 2012 is MUCH worse than you thought”. In it, I explained how the Republican budget passed in the first year after the 2010 midterm election annihilation of Democrats and signed into law by Governor Rick Snyder created a massive shift of taxation from the wealthy and from corporations onto the poor and middle class. Here’s a bit of that post:

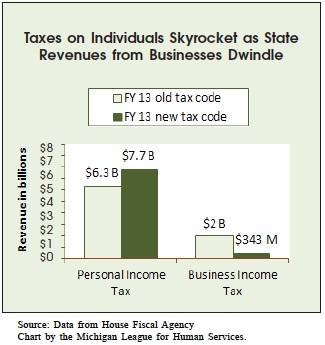

[A]s we all know, last year the Michigan Republicans passed a budget that lowers business taxes by $1.6 billion and increases individual income taxes by $1.4 billion.It looks like this:

What is shocking is how easy the budget goes on upper income Michiganders and how astonishingly HARD it hits lower income residents…In fact, when you look at the total state and local taxes as a percentage of income of those making $334,000 or more per year vs. those making $17,000 year or less, the poorest people pay 1000 times more than those at the top of the food chain. The poorest Michiganders pay 1.0% of their income vs. 0.001% for the top earners.

Other things from the report that you should know about the tax time bomb that explodes in Michigan in 2012:

- Reduces the Earned Income Tax Credit (EITC) for the working poor from 20% to 6% of the federal credit – a 70% cut.

- All major tax credits except the Homestead Property Tax Credit are now gone. Donations to food banks, shelters, and food kitchens: gone. Donations to charities: gone.

- Taxes are instituted or increased on private and public pensions for certain groups of senior citizens/retirees.

- Deduction for children in the family has been eliminated.

- Homestead Property Tax Credit (HPTC) has been taken away for over a quarter million Michiganders with incomes between $50,000 and $82,650. Seniors with incomes between $30,000 & $50,000 will have this credit reduced by 40%. Only half of the working poor that qualify for the EITC will also qualify for the HPTC.

At the end of the day, here’s a very important thing to remember: Thanks to the new Republican budget, 51% of all Michigan tax payer will pay MORE in personal income taxes in 2012 and beyond. Read that again. Over HALF of Michiganders will pay MORE TAXES because of the Republican budget.

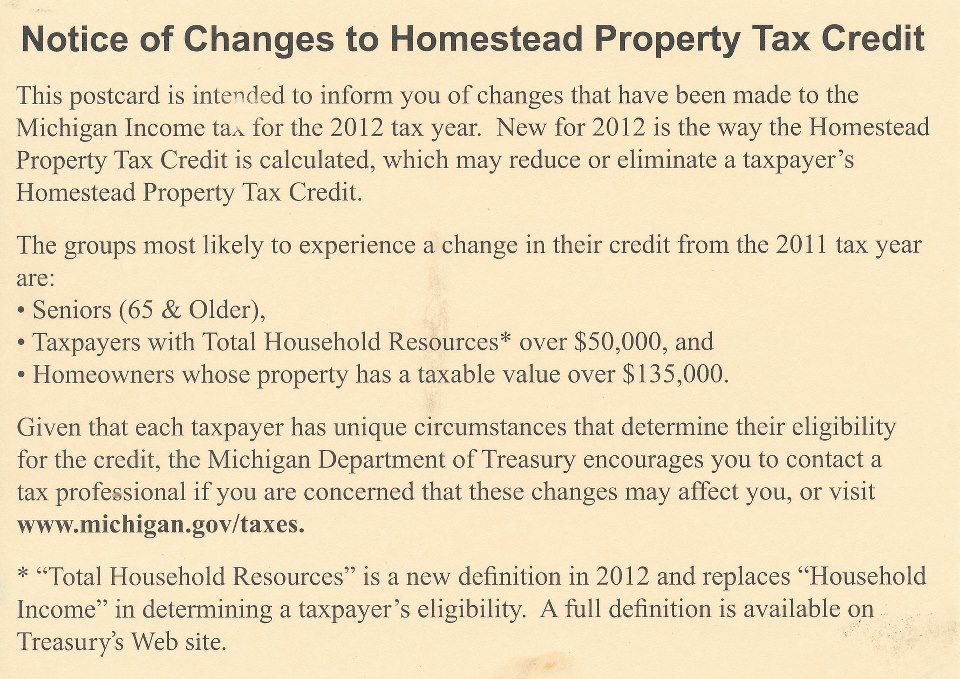

By December, the tax time bomb had begun to explode. Many people in Michigan received this card from the State Department of Treasury:

Here’s what I wrote about it then:

That bit at the end is interesting. The main difference between “Total Household Resources” and “Household Income” is that you can no longer take into account “business, farm, rental and royalty income or loss”. If you lost money this way, you used to be able to subtract it, reducing your overall income (and paying less taxes.) Now you enter “zero”. This is the sort of tax credit that wealthier Michiganders can avail themselves of. However, the Republicans have seen to it that this way of reducing your overall income, this tax break, is NOT available to our poorest citizens.

Here in 2014, we’re all feeling the bite of these Republican tax hikes. Well, all of us except our wealthiest residents and the corporations who benefit from our roads, police & fire protections, natural resources, and other public services our tax dollars pay for. Those groups aren’t feeling the pinch at all. You’d think our corporations would be wallowing around in so much profit that they’d be hiring like crazy but, despite the massive tax break, Michigan still ranks 46th in national unemployment.

The Michigan Democratic Party has begun talking about our values as a state and how they affect the way we believe the state should be run, what they call “The Michigan Way”. These values of fairness, equality, and equal opportunity are betrayed by Republican efforts to benefit corporations and the wealthy at the expense of everyone else. That’s NOT “The Michigan Way” and they urge everyone to support their efforts by taking the pledge to vote “The Michigan Way” at GoMIWay.com.

Our friends at Progress Michigan have put out another “Fake Rick Snyder” video specially for today to remind us in a humorous way just exactly how much the middle class and poor residents of Michigan have been betrayed and run over by Michigan Republicans.

In a statement released with the video, Sam Inglot, project director of Progress Michigan’s SnyderFails.org project, said, “One of the greatest criticisms of Gov. Snyder has been his wrong priorities — especially when it comes to taxes. Tax policies that only benefit the wealthy elite and corporations is not the way to help out Michigan families, but unfortunately, that’s exactly what Gov. Snyder has implemented.”

All of this should make Michiganders angry. If you ARE angry, do what the tea partiers did: funnel that anger into something constructive politically. Get active by joining up with your local Democratic party or your favorite candidate and start making phone calls and knocking on doors. You don’t have to memorize a bunch of facts to give to people. You just have to explain how Republicans are not voting The Michigan Way and how Democrats represent the true Michigan Way of fairness and equal opportunity for EVERYONE, no matter how much money you make, who you love, or what you look like.

Get involved today. We simply cannot afford to lose in November.