Don’t worry, that was just your retirement income being flushed down the proverbial toilet

When the stock market crashed at the end of 2008 while George Bush was phoning in his last six months in office, retirees across the country watched as their nest eggs, retirement income accumulated over decades by investing in stocks and bonds, mainly through 401K plans, evaporated nearly over night. I personally knew of a number of recent retirees at the time who were forced to come out of retirement to work. Now in their sixties, they had few options other than to become greeters at Walmart and other jobs that scarcely dignified the years and years they had worked as professionals before they retired.

When the stock market crashed at the end of 2008 while George Bush was phoning in his last six months in office, retirees across the country watched as their nest eggs, retirement income accumulated over decades by investing in stocks and bonds, mainly through 401K plans, evaporated nearly over night. I personally knew of a number of recent retirees at the time who were forced to come out of retirement to work. Now in their sixties, they had few options other than to become greeters at Walmart and other jobs that scarcely dignified the years and years they had worked as professionals before they retired.

This shining example of how unpredictable the stock market is was Reason Number One that so many members of Congress, primarily Democrats, fought tooth and nail to prevent their Republican colleagues from turning over Social Security and Medicare to 401K-style investment plans. The facts were right there to behold: if the market tanks, you are left with no retirement income and no ability to pay your medical bills. Period.

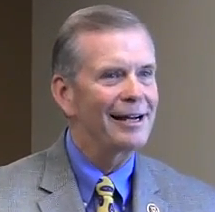

Still, that hasn’t prevented Republicans like Tim Walberg from Michigan’s 7th Congressional District from continuing to promote making Social Security and Medicare into 401K-style plans. Just this past week he said so in an appearance in Chelsea, Michigan:

[We need to] find a system that will be more of a choice system — with Social Security still as an option — but other options that will be qualified for people like yourself to make decisions about whether it’s a 401K-type plan that over the long haul works. Short-time burps take place at times [smiles] — but over the long-haul works. Or some other mechanism. Make sure that you understand, number one, your retirement is yours. So you better plan for it. Secondly, there are people and agencies that will help you and there are certain minimum requirements that a government ought to expect. You don’t just spend it on frivolous things but it goes exactly where it’s supposed to go and that’s taking care of you in your retirement years.

“Short-time burps”? That’s how a sitting member of Congress describes the stock market crash of 2008-2009 and the subsequent Great Recession that resulted from it?

That was no “burp”. It looked like this:

The market didn’t “burp”. The market lost over half of its value in the course of about a year and a half. It took another four years for it to regain everything that it lost.

It’s one thing to be wrong when you don’t have enough evidence to make a good decision. It’s another thing to be wrong when you have the evidence to show that you’re wrong staring you in the face. But it’s an entirely ignorant and intentionally deceptive thing to rewrite history and change the facts everyone else can see to bend them to fit your narrative as Tim Walberg has done here.

Two more points. First, those “people and agencies that will help you” make your investment choices for your retirement? Those are people who stand to make a lot of money if you invest with them. You won’t hear from them about the type of risk you are facing if you place all of your retirement eggs in the stock market basket. Bullet-proof young people are particularly vulnerable to believing that they can win in the stock market, particularly with a glib fund manager whispering in their ear.

Second, I find it supremely ironic that Walberg has this to say:

[T]here are certain minimum requirements that a government ought to expect. You don’t just spend it on frivolous things but it goes exactly where it’s supposed to go and that’s taking care of you in your retirement years.

Walberg seems perfectly happy to have “minimum requirements that a government ought to expect” with regard to betting your entire retirement income on the stock market. He’s got an entirely different song to sing when the it comes to your health insurance, however. There, like the rest of his tea party brethren, he wants the government to play no role whatsoever and characterizes having minimum standards as “government-run health care”.

Tim Walberg is a hypocrite and, clearly, a deceitful one at that. I look forward to working hard for Pam Byrnes so that she defeats him soundly in November 2014 and sends him back to being a pastor where, of course, he’ll enjoy the rest of his life fully covered by healthcare insurance from his jobs in the state legislature and Congress and with a tidy pension from those jobs, as well.

You can make a financial contribution to Pam Byrnes’ campaign HERE.