Class War – n. the only war George W. Bush ever won

Why are only the rich getting richer? Why — as Maryland’s governor Martin O’Malley asks — hasn’t the middle class had a raise in 13 years? Why are corporate profits at an all-time high but wages at an all-time low as a share of GDP?

Why are only the rich getting richer? Why — as Maryland’s governor Martin O’Malley asks — hasn’t the middle class had a raise in 13 years? Why are corporate profits at an all-time high but wages at an all-time low as a share of GDP?

We can blame globalization and rapid development of information technology. But two new studies confirm what you’ve probably already knew: Conservative policies are rapidly shrinking the middle class and engineering a massive transfer of wealth the richest Americans.

A new study “The Top 1 Percent in International and Historical Perspective“, confirms a thesis that tax expert and Pulitzer Prize-winning journalist David Cay Johnston has been advancing since 2003, “Under current government rules, an ever-greater share of economic resources must flow to the top over time because those rules subtly redistribute upwards.”

This is why the rich have gotten richer in Japan, France and Germany but nowhere close to as rich as the wealthy in America and Britain. While union-busting definitely fuels growing inequality in the U.S., the study finds that tax cuts for the rich — the hallmark issue of our Republican Party — is most responsible for this growing inequality.

Though the GOP sells these cuts on the promise that they will grow the economy, the study finds that the rich benefit but the economy does not: “Countries that made large cuts in top tax rates, such as the United Kingdom or the United States, have not grown significantly faster than countries that did not, such as Germany or Denmark.”

And while Republicans love to tout how Reagan used deficits to outspend the Soviets and possibly hasten the end of the Cold War, they refuse to note that the most lasting impact of the Gipper’s policies is a huge distortion of our economy in favor of the rich. This is a distortion only made worse by George W. Bush’s tax cuts which were such failures you can’t even find economists willing to defend them.

In 1981 the top 1 percent had 10 percent of all reported income, but by 1999 they were at 20 percent. That share has risen and fallen with the economy since, but the 12-year average shows the top 1 percent enjoying a fifth of all income since 2000.

Ending the Bush tax breaks on income over $400,000 and raising the inheritance tax slightly will slightly improve this trend. But the lasting impact of the Reagan and Bush economic plans is still intact, the Century Foundation’s Benjamin Landy points out in an examination of new report from the Congressional Budget Office:

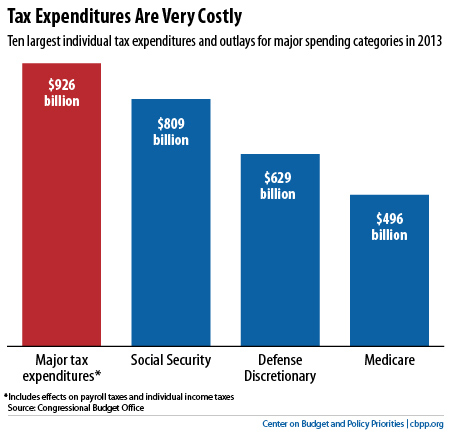

Of the $900 billion that taxpayers can expect to save in 2013 through the 10 largest tax credits and deductions, more than half will go to the richest 20 percent… Nearly one fifth of the $900 billion will go to the richest 1 percent, who benefit disproportionately from the deduction for charitable giving and the preferential tax treatment for capital gains and dividends.

While Republicans argue that we cannot afford Social Security, Medicare, food stamps for the poor or student loans subsidized at the same low rate banks, they never point out that our deficit would be just about gone if we eliminated the tax breaks that go to the top 20 percent.

Conservative arguments generally come back to asserting that taxes are basically confiscation and the rich deserve to keep what they earn/inherit/swindle. As if the rich don’t get huge benefits from a country that can afford “provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity.”

They may not realize it now, but the richest don’t want to live in a country of over 300 million without a middle class — it makes being rich a lot less fun when you’re constantly worried about having to defend your massive assets and family, for real.

But that’s exactly the kind of country they’re creating.

[Graph by the Center for Budget and Policy Priorities.]