This is why Mitt Romney pays a lower tax rate than you do

I’m about to shock you.

I’m about to shock you.

Read this: “Skewing income toward the upper, upper class hurts our economy because the rich tend to sit on their money — unlike lower- and middle-income people, who spend a large share of their paychecks, and hence stimulate economic activity.”

Guess who wrote it?

A Republican — the same guys who now won’t take credit for the sequestration cuts they won. And not just a regular Republican, the Republican woman who George W. Bush picked to run the FDIC — Shelia Bair.

In 2013, it’s nearly a miracle when someone who identifies as a Republican dares to state common sense.

But Bair didn’t stop there in her recent op-ed for the New York Times “Grand Old Parity.” She called on the GOP to end the tax breaks we give to hedge fund managers that allow them to treat their income as investment income — a heinous exploitation of the tax code that has been protected by Republicans and a few Democrats due to the outrageous amount of money the financial industry spends on lobbying.

Bair says it needs to stop. “…Republicans should put fundamental tax reform on the table and make it our priority to end preferential treatment of investment income, which lets managers of hedge funds pay half the tax rate of managers of shoe stores,” she wrote.

This protection for millionaire and billionaire hedge fund managers costs America up to $13 billion a year. That’s not enough to replace the $85 billion in cuts in the sequestration that will cost us 750,000 jobs. But it’s a huge start.

But this is the issue we face. Republicans won’t even considering ending this tax break — or tax breaks for big oil, people who own corporate jets or any tax breaks. They insist that letting the Bush tax cuts expire for income over $400,000 was enough new revenue forever and the only tax reforms they’ll allow must lower rates.

Basically, the GOP is protecting tax breaks for those who need them least and making cuts to a middle class that’s suffering. And while they used to say that this would grow the economy, they’re now admitting that it will hurt the economy by blaming the president for the sequester.

Remember: This isn’t just punishment for electing President Obama. I believe this is the GOP’s strategy for 2014. They recognize that what was behind their victory in 2010 wasn’t the Tea Party or Obamacare, it was the terrible economy. So anything they can do to protect their billionaire base while hurting the middle class is a win for the sad thing we still call the Republican Party.

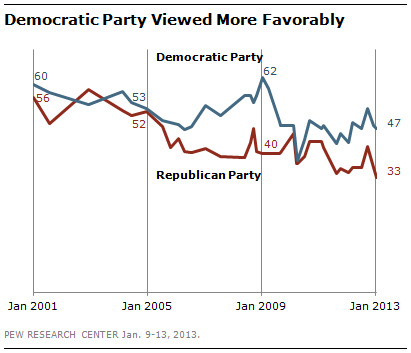

The only good news is that Americans seem to noticing what the GOP is pulling. Their approval rating is lower now than after the Iraq War or the worst of the financial crisis, according to PEW. And 62% say they’re “out of touch.”

But any time this party’s approval rating is above 1%, we all know someone in being fooled.

[Image credit: DonkeyHotey]