That advice wasn’t good for consumers. But it sure must have been good for Trott’s business handling foreclosures.

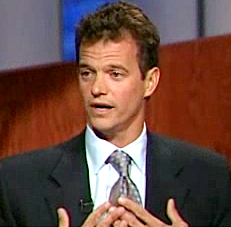

David Trott, chairman and CEO of one of the country’s largest law firms specializing in foreclosure services for the mortgage industry — and a Republican candidate running in Michigan’s 11th Congressional District — has got some explaining to do.

In September 2007, subprime mortgage firms were declaring bankruptcy, other financial institutions were refusing to take on more subprime loans and millions of Americans were at risk of losing their homes. At that same time, Trott appeared on the Michigan TV program “Due Process” and called subprime mortgages “a perfectly appropriate product.”

Yes, David Trott defended subprime mortgages even as the subprime mortgage market was collapsing. That collapse contributed significantly to the larger financial crisis that wreaked havoc on the global economy.

Trott’s statements on “Due Process” make it clear he didn’t see anything wrong with endorsing a product he knew very well would result in even more foreclosures — risking the homes of average Americans while driving more business to his law firm.

Click through for video and more.

Read more ›