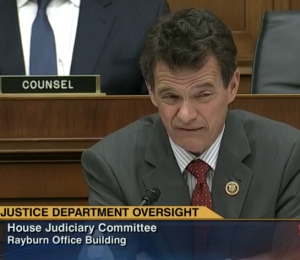

In what can only be described as a laughable op-ed in The Detroit News today, multi-millionaire Republican and Foreclosure King David Trott attempts to portray a Republican bill to roll back consumer financial protections under Dodd-Frank and kneecap the Consumer Financial Protection Bureau (CFPB), a federal bureau that has “won almost $12 billion in refunds and relief for an estimated 29 million Americans who’ve been defrauded by financial companies,” as the panacea to all the things holding America back. What Mr. Trott fails to mention is that the bill’s sponsor, Jeb Hensarling has received over $7 million in political donations from companies regulated by the CFPB. Trott (laughably, as I said) suggests that we live in a dystopian world where “many Americans have not felt any real recovery and millions of people remain out of work, …wages have remained stagnant, life savings and nest eggs have declined, and the futures of Michigan families have been placed at risk.” Passage of Hensarling’s “Financial CHOICE Act”, Trott says, will make this all go away and provide “individuals and families with the opportunity to choose the checking accounts, mortgages, retirement plans, and credit cards that work for them.” Not only that, he says, it will “boost Michigan small businesses’ access to the resources they need to expand, innovate, invest, and hire more employees.”

In what can only be described as a laughable op-ed in The Detroit News today, multi-millionaire Republican and Foreclosure King David Trott attempts to portray a Republican bill to roll back consumer financial protections under Dodd-Frank and kneecap the Consumer Financial Protection Bureau (CFPB), a federal bureau that has “won almost $12 billion in refunds and relief for an estimated 29 million Americans who’ve been defrauded by financial companies,” as the panacea to all the things holding America back. What Mr. Trott fails to mention is that the bill’s sponsor, Jeb Hensarling has received over $7 million in political donations from companies regulated by the CFPB. Trott (laughably, as I said) suggests that we live in a dystopian world where “many Americans have not felt any real recovery and millions of people remain out of work, …wages have remained stagnant, life savings and nest eggs have declined, and the futures of Michigan families have been placed at risk.” Passage of Hensarling’s “Financial CHOICE Act”, Trott says, will make this all go away and provide “individuals and families with the opportunity to choose the checking accounts, mortgages, retirement plans, and credit cards that work for them.” Not only that, he says, it will “boost Michigan small businesses’ access to the resources they need to expand, innovate, invest, and hire more employees.”

It’s almost like magic. And it’s all a bald-faced lie.

Here are some of the noteworthy things this legislation does:

- Eliminates independent funding of the CFPB designed to keep it away from the politically-charged environment of the appropriations process.

- Allows the CFPB director to be fired for any reason, making that person’s job subject to political whims.

- Eliminates the CFPB’s Unfair, Deceptive or Abusive Acts and Practices (UDAAP) authority, giving that authority to the Federal Trade Commission. This means “no agency overseeing non-bank financial players has the ability to write rules based on such practices, since the FTC has no rule-writing powers to speak of.”

- Eliminates the CFPB’s supervisory authority over all banks greater than $10 billion in assets.

- Makes the Office of Older Americans, the Office of the Student Ombudsman, the Office of Service Member Affairs, and the Office of Financial Empowerment, all currently permanent offices in the CFPB, “optional”.

- Eliminates the Public Consumer Complaint database which has published over 1.1 million consumer complaints since the CFPB came into existence.

- Eliminates the CFPB’s authority to regulate predatory payday lenders.

- Eliminates the “Durbin amendment” which regulates how much credit card companies can charge vendors for using their cards, a clause in the Act that, according to the Merchant Payments Coalition, has saved consumers $30 billion.

- Forces the CFPB to get congressional approval before taking enforcement action against financial institutions.

- Repeals the Volcker Rule, allowing banks to once again gamble with depositors’ money.

- Erodes shareholders’ rights which, according to Brandon Rees, Deputy Director of Investment for AFL-CIO, “would be a disaster for investors.”

It’s hard to find anything that protects consumers and keeps Wall Street banks in check in that laundry list of wet kisses to the banking industry. For a more intensive look, check out the analysis from the Americans for Financial Reform HERE.

Obviously Trott doesn’t mention ANY of this. Instead, he paints a rosy picture of sunsets and butterflies that will benefit individuals and families. In reality, the bill unshackles Wall Street banks from the “burden” of protecting consumers, allowing them to once again do pretty much whatever they want, free from pesky oversight by the CFPB (which the legislation would rename to the “Consumer Law Enforcement Agency.”)

When a multi-millionaire who earned his millions in part by preying on victims of the very same Wall Street banks that caused the Great Recession tells you he supports banking “reform” legislation because it will solve all your financial problems, take a second look. If it seems like he’s blowing smoke into your nether regions there’s a very, very good reason for that:

He is.