At a public appearance this past weekend, Republican Congressman Tim Walberg told the crowd at an impromptu townhall, “Remember, the Affordable Care Act was passed without CBO [Congressional Budget Office] scoring.” This is false. Although the CBO hadn’t scored earlier versions of the ACA passed in the House and Senate, the final bill was scored several days before the final vote. And, as it turns out, they pretty much nailed it.

At a public appearance this past weekend, Republican Congressman Tim Walberg told the crowd at an impromptu townhall, “Remember, the Affordable Care Act was passed without CBO [Congressional Budget Office] scoring.” This is false. Although the CBO hadn’t scored earlier versions of the ACA passed in the House and Senate, the final bill was scored several days before the final vote. And, as it turns out, they pretty much nailed it.

Yesterday, the nonpartisan CBO released its assessment of the Republican plan to repeal the ACA known as the American Health Care Act (AHCA) and, as expected, it is going to be devastating for many Americans:

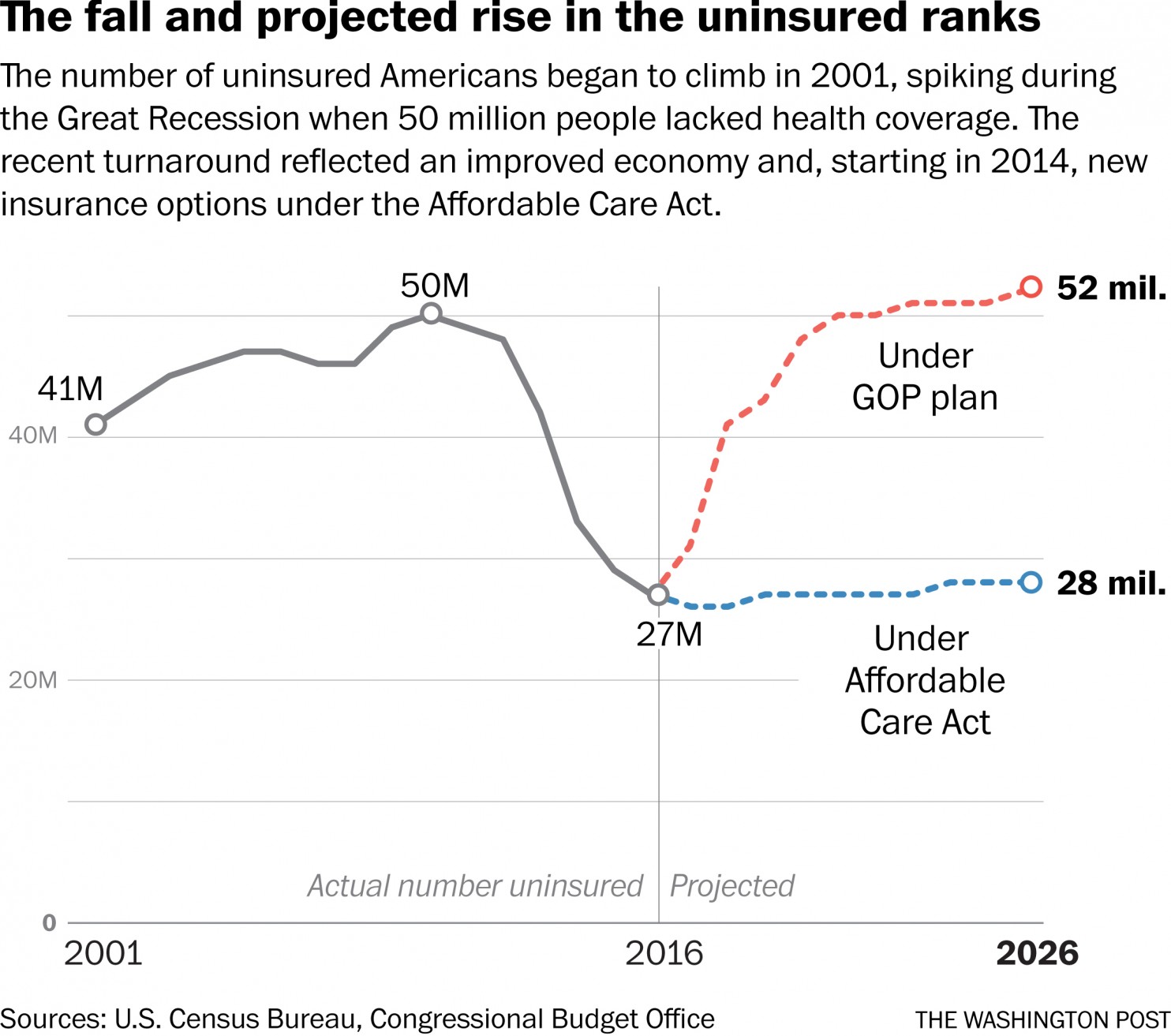

The analysis, released late Monday afternoon by the Congressional Budget Office, predicts that 24 million fewer people would have coverage a decade from now than if the Affordable Care Act remains intact, nearly doubling the share of Americans who are uninsured from 10 percent to 19 percent. The office projects the number of uninsured people would jump 14 million after the first year.

But the GOP legislation, which has been speeding through House committees since it was introduced a week ago, would lower the deficit by $337 billion during that time, primarily by lessening spending on Medicaid and government aid for people buying health plans on their own.

That drop in people who have health insurance is essentially the same amount who GAINED health insurance under the ACA:

It does this, in part, by cutting nearly a trillion dollars out of Medicaid expenditures over the next ten years. The Republican “Repeal and Disgrace” plan, what LOLGOP calls ‘LoserCare’, “functionally ends the ACA’s Medicaid expansion in 2020“.

This massive drop in the number of insured Americans doesn’t bother House Speaker Paul Ryan, though. To him, the comparison in the number of people covered by the ACA vs. the AHCA is just “a beauty contest” and it’s not the goal of Republicans, he said, “to win some coverage beauty contest.”

Senate Finance Committee Chairman Orrin G. Hatch acknowledged that the drop in the number of people with health insurance will be huge but said, “[L]et’s face it, this is a tough baby to take care of and there will be some people who are left out. There isn’t enough money in the world to cover everybody the way they’d like to be covered.”

In other words, the Republican message to the millions of Americans who will go uninsured is “tough rocks.”

If passed, the AHCA will clearly be a roll back of the massive gains from the ACA. But that didn’t stop Pr*sident Trump from continuing to characterize it as a massive failure. Yesterday, during a dog-and-pony show where he trotted out people who say they’ve been irreparably harmed by the ACA, Trump called the ACA “the very, very failed and failing Obamacare law” and said “it covers very few people and it’s imploding.”

That will likely come as news to the 25 million or more people who now have health insurance who would not have had it without the ACA. In fact, the premium increases under the ACA that are being used to justify scrapping it impact just 3% of Americans.

Trump administration officials – who love the work of the CBO until they don’t – quickly discounted the assessment. “We disagree strenuously with the report that was put out,” HHS Secretary Tom Price told reporters at the White House. “We believe that our plan will cover more individuals at a lower cost and give them the choices that they want for the coverage that they want for themselves and their family, not that the government forces them to buy.”

White House budget director Mick Mulvaney defended the Republican’s rush to pass AHCA with only two hearings, very little debate, and almost no public input. “We already had two committee hearings, which I believe is two more than Obamacare had in the House,” he said on ABC’s “This Week” on Sunday. In actuality, there were at least 20 hearings on the ACA.

But not everyone is a loser with the AHCA. The more income you have, the more you’ll benefit. While a A 64-year-old man with an annual income of $26,500 would pay $12,900 more for their health insurance coverage by 2026 (that’s roughly half their income, by the way), a 40-year-old with an annual income of $68,200 would pay $4,100 LESS.

But that’s not the half of it. The real benefit for the wealthy goes to the truly wealthy:

Two of the biggest tax cuts in Republican proposals to repeal the Affordable Care Act would deliver roughly $144 billion over the coming decade to those with incomes of $1 million or more, according to a congressional analysis. […]

People making $200,000 to $999,999 a year would also get sizable tax cuts. In total, the two provisions would cut taxes by about $274 billion during the coming decade, virtually all of it for people making at least $200,000, according to a separate assessment by the committee.

“Repeal-and-replace is a gigantic transfer of wealth from the lowest-income Americans to the highest-income Americans,” said Edward D. Kleinbard, a professor at the University of Southern California law school and former chief of staff for the Joint Committee on Taxation. […]

The analysis found that by 2020, the repeal of the two tax provisions would save about $15.9 billion a year for those with incomes of $1 million or more. By 2026, the final year of the analysis, they would combine to save that group a little more than $20 billion a year.

There’s one other big winner: health insurance companies. The ACA mandates that all Americans have health insurance and, if you don’t, you pay a fine to the federal government. The AHCA has a different approach to encouraging people to buy health insurance. If your coverage lapses for more than 63 days, the insurance companies will charge you a 30% premium surcharge for the next year – a surcharge that flows into THEIR bank accounts. In other words, heads, the insurance companies win, tails the health insurance consumer loses. This is a win-win situation for health insurance companies because they’ll get your money even if you decide to wait to buy insurance until you get sick. It’s also a recipe for a return of the healthcare-related bankruptcy epidemic that was largely ended with the passage of the ACA.

If you’re wondering how many people allowed their health insurance to lapse longer than 63 days last year, the answer is a lot:

The Biennial Health Insurance Survey indicates that in 2016, 21 percent of adults ages 19 to 64, or an estimated 40 million people, had experienced a gap in their health insurance. These adults reported that they were either uninsured at the time of the survey, or that they were insured and had experienced a gap in coverage.

Among this group with a gap in insurance, 75 percent, or about 30 million people, had been uninsured for longer than three months, which is slightly longer than the 63-day gap period allowed under the House bill. Excluding people who never had insurance, 21 million adults might have been subject to a penalty. While some people with coverage gaps might have ultimately gained coverage through an employer or Medicaid, the estimate suggests the size of the population that would face a surcharge in a given year.

So, once again, in the discussion between whether it’s worse to throw millions of Americans off health insurance or to impose a relatively tiny tax on the super wealthy, the Republicans have shown whose side they are on. If you’re not wealthy, the side they’re on ain’t yours.

I’ll finish with this analysis from Jared Bernstein of the Washington Post:

I can think of no other explanation for this plan than this: Republicans looked out at the country and concluded that the wealthy had too little after-tax income and the poor had too much health care. So, they wrote a bill that transferred about a trillion dollars that would otherwise have paid for Medicaid benefits and subsidies for low-income older persons to the wealthy in tax cuts and the well-off young in lower premium costs, with a bit of deficit reduction thrown in to meet the requirements of the budget process. Poverty policy expert Bob Greenstein told Vox that “No legislation enacted in recent decades cut low-income programs this much — or even comes close.”

For those of you who thought that punishing the poor and rewarding the rich was a caricature of conservative policy, the bill should disabuse you of that impression. Readers of this column know I’m rarely at a loss for words, but I just don’t know what else to say about this. In the pantheon of mean-spirited, greedy, self-serving, inequitable and unjust conservative policy, this bill stands alone.

*Donald Trump is the biggest loser of the popular vote to ever become President of the United States.