Private school vouchers are the zombies of the education reform agenda. No matter how many times they are defeated at the ballot box, they just won’t die.

Private school vouchers are the zombies of the education reform agenda. No matter how many times they are defeated at the ballot box, they just won’t die.

Vouchers are overwhelmingly unpopular with voters, contribute to school segregation, don’t help poor families attend the “school of their choice,” and the most recent research on vouchers suggests that the students who use them perform worse academically than their peers in public schools. And now, with the full force of our new President, the former CEO of his very own private, fraudulent, for-profit “charter university,” and his stunningly unqualified, docile, and compliant Secretary of Education, behind the re-birth of these programs, we are seeing a full-fledged zombie apocalypse of voucher enthusiasm.

Let’s take a look at the disconnects between what voucher advocates have promised, and what vouchers have actually delivered.

The Unpopularity of Private School Vouchers

Just how unpopular are vouchers with the American public? As education historian, Dr. Diane Ravitch, points out, very:

When Ms. DeVos and her husband Richard led a movement to change the Michigan state constitution to permit vouchers for religious schools in the year 2000, the referendum was defeated by 69-31%. Even in deep red Utah, the public rejected vouchers overwhelmingly in 2007. Florida was the last state to reject vouchers, in a 2012 vote deceptively named the Religious Freedom Act; it was defeated by 58-42%.

Vouchers are so unpopular that conservatives like Ms. DeVos have now turned to a favorite business practice, “rebranding,” in an attempt to trick the public into supporting them.

Rebranding is a marketing strategy in which a new name, term, symbol, design, or combination thereof is created for an established brand with the intention of developing a new, differentiated identity in the minds of consumers, investors, competitors, and other stakeholders.

Notable examples of rebranding include tobacco giant Phillip Morris changing its name to Altria to avoid association with the negative image the company had developed. Closer to home, in perhaps an uncomfortable reminder for Ms. DeVos, her brother’s notorious private mercenary firm, Blackwater, rebranded itself as Academi after a group of its employees killed 17 Iraqi civilians and injured 20 more in Baghdad in 2007.

DeVos and other voucher advocates have begun using terms like “education tax credits,” “education debit cards,” and “neovouchers” to try to throw citizens off the scent of their true intentions. In Florida, a state that both Trump and DeVos consider a “second home”, the Florida Tax Credit Scholarship program offers a neat end-around to avoid the impression that tax dollars are going to subsidize private and religious school tuition–which is exactly what the program does.

Established in 2001 under former Gov. Jeb Bush, it has allowed businesses to earn a tax credit in exchange for donating money to send low- and middle-income children to private schools.

This year, for example, about 90,000 low-income children attend more than 1,600 private schools, mainly church-affiliated. The average scholarship equals about $5,900.

Here’s how the tax credit program works:

Florida allows corporations to apply for a tax credit for donations to an “eligible nonprofit scholarship-funding organization” (F.S. 220.1875). The value of the credit is 100 percent of the donation made. The credit can be applied to multiple forms of taxation including corporate income tax, sales tax, some excise taxes, insurance premium tax, and severance tax. Each has its own cap on the value of the credit, however, the income tax credit is awarded the most. A corporation can apply for a credit worth up to 75 percent of its total income tax liability. As a whole, the state awards a maximum of $140 million (FY 2011) in scholarship tax credits. However, Florida’s statewide limit is flexible, meaning if the amount of corporate donations made exceeds 90 percent of the tax credit limit ($140 million) it automatically increases by 25 percent.

In essence, the Florida Tax Credit program is a state-sanctioned money laundering scheme. Knowing that citizens would object, as they have in the past in the state, to the idea of public tax revenues going to support private institutions, former Gov. Bush and his ed reform cronies devised a scheme in which tax revenues that were slated to be deposited in state coffers–such as corporate income taxes–could be redirected as “donations” to private and religious school scholarships. In exchange, the corporation making the donation receives a dollar-for-dollar tax credit–a win-win for the corporation, and a lose-lose for the state’s public schools.

In Tennessee, the voucher comes in the form of an “education debit card.”

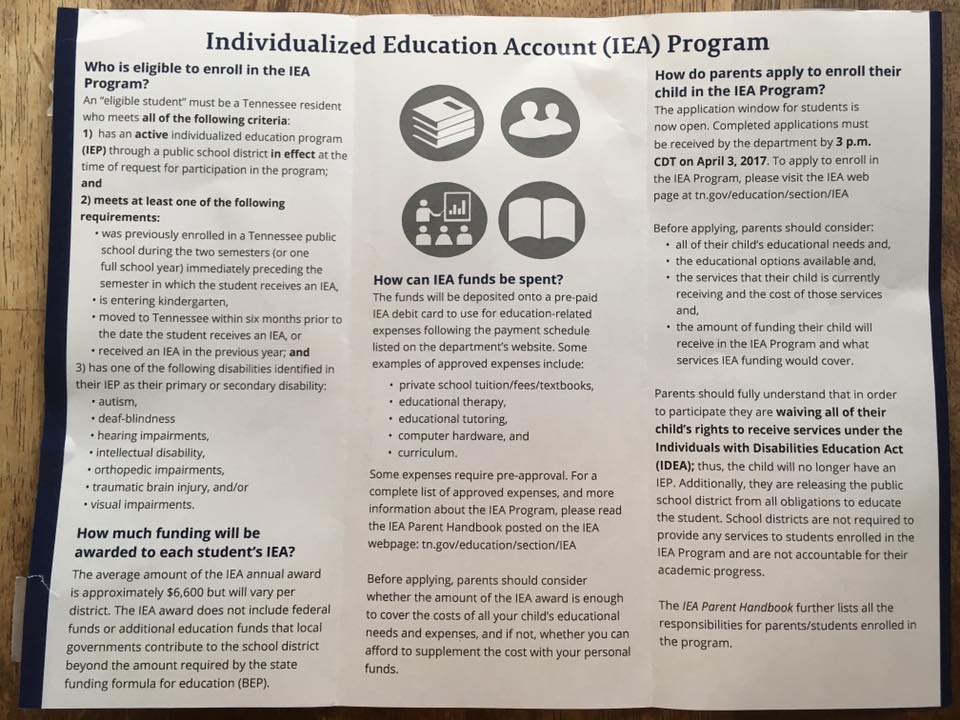

Tennessee’s Individualized Education Account (IEA) program offers a debit card preloaded with $6600 that families can use to pay for “approved education-related expenses,” such as private school tuition, educational therapy, tutoring, and computer hardware. Imagine how enticing a $6600 debit card might be to a poor family struggling to pay their bills; how tantalizing would the idea of a “free” computer for their child be, and money to pay for tutors or therapy for a child with learning challenges?

But a “close reading” of the fine print reveals the dangers lurking for parents who accept this Faustian bargain…

Parents should fully understand that in order to participate they are waiving all of their child’s rights to receive services under the Individuals with Disabilities Education Act (IDEA); thus, the child will no longer have an IEP. Additionally, they are releasing the public school district from all obligations to educate the student. School districts are not required to provide any services to students enrolled in the IEA Program and are not accountable for their academic progress.

Before applying, parents should consider all of their child’s educational needs…and the amount of funding their child will receive in the IEA Program and what services IEA funding would cover.

These kinds of trade offs are common features of voucher schemes, many of which target children with special needs. We’ve already seen how little Secretary of Education DeVos knows, or cares, about IDEA and the other federal programs she is now responsible for administrating. Her support for vouchers promises to remove the protections that IDEA and other civil rights initiatives sponsored by the Department of Education have provided for our most vulnerable (i.e., students who require special education services, transgender kids) children.

Making matters even worse, the average parent often has little idea of what it costs to educate their child for a year, and these costs can vary widely depending on the student’s needs, academic ability, and particular learning challenges or disabilities. But the education reformers in Tennessee know exactly how much it costs, and they see these IEA debit cards as a way to turn a profit by shirking the state’s responsibility to educate their children:

According to the U.S. Department of Education, Tennessee taxpayers spend approximately $9,000 per student in traditional schools. However, students using an Individualized Education Account will be funded at $6,500. Beacon Center research finds that each account could save local school districts an average $1,000, even after fixed costs are considered.

There’s a certain craven sense of financial calculation at play here that has nothing to do with acting in the best interests of children or families. The Tennessee IEA program is not about providing school choice, or offering alternatives to children “trapped in failing schools.” Rather, it’s all about viewing children and families as ATMs, valuable sources of public tax dollars that can be re-appropriated towards private bank accounts.

Vouchers Increase School Segregation

While support for vouchers often comes wrapped in the social justice rhetoric of “opportunity” and “choice,” research has shown that vouchers have proven to increase school segregation when implemented in other countries.

Research on large-scale private school vouchers and similar school choice programs in Sweden, Chile, and The Netherlands suggest that in each case those programs have increased socioeconomic and racial segregation in schools. A 2013 study on Chile found that school segregation by socioeconomic status (SES) increased in Chile as market-based reforms grew, and private schools, including those receiving vouchers, were more segregated than public schools for both low-SES students and high-SES students. A 2015 study on Sweden found that the use of private school vouchers was associated with increased segregation of immigrant versus native Swedish students. And in The Netherlands, a marketplace approach to education has contributed to high and growing levels of segregation of students by educational disadvantage.

Indeed, the very origins of private school vouchers are cloaked in racist and classist overtones. As Sen. Elizabeth Warren wrote recently to Sec. DeVos:

After Brown v. Board of Education and the court-ordered segregation of public schools, many Southern states established voucher schemes to allow white students to leave the education system and take taxpayer dollars with them, decimating the budgets of the public school districts. Today’s voucher schemes can be just as harmful to public school district budgets, because they often leave school districts with less funding to teach the most disadvantaged students, while funneling private dollars to unaccountable private schools that are not held to the same academic or civil rights standards as public schools.

The evidence suggests that vouchers aren’t working any better in the US. A recent report from the Southern Education Foundation (SEF) uses data from the National Center for Education Statistics from 1998 and 2012 to show that private school vouchers have only reinforced the racial stratification between public and private schools. Their report identifies the following as matters for concern: “overrepresentation of white students, disproportionate white enrollment rates, virtual segregation (90% or more white student population), and virtual exclusion of students of color. All of which suggest that segregation persists in private schools across the country and especially in the South.”

The authors go on to suggest that private school vouchers, while marketed and promoted as levers for social change, actually serve to perpetuate a two-tiered system of schooling, especially evident in the South; elite private schools for the wealthy, and mostly white, families that can afford them, and a crumbling and increasingly de-funded public school system for the poor, mostly black and brown children that can not.

The six Deep South states, Alabama, Georgia, Louisiana, Mississippi, North Carolina, and South Carolina, which resisted the constitutional mandate for school desegregation the longest are the worst offenders in the nation by far – demonstrating that state support of private schooling does not appear to have led to greater access for students of color. These six states had a considerably higher rate of overrepresentation among white students in private schools than any other section or region in 2012. Five of the six states were at the top of the state rankings in 2012 and the sixth, Alabama, was ranked tenth.

Vouchers Don’t Help Poor Children Attend the “Schools of Their Choice”

While voucher advocates claim that these programs will allow poor children to escape their “failing public schools”, and “give parents the power to opt their children out of poorly-performing schools assigned by zip code”, the actual math when it comes to vouchers just doesn’t add up.

Let’s run the numbers with a couple of examples.

Donald Trump, a huuge supporter of private school vouchers, has promised to devote $20 billion to a new federal voucher initiative. Disturbingly, this money is rumored to be coming out of existing Title I funds. Title I is “a long-standing federal program meant to send additional money to school districts that serve at-risk students,” so Trump’s approach to funding his voucher scheme would be doubly and disproportionately devastating in that it would take money away from the schools and children who need them the most, and redirect these funds towards private and religious schools.

Example #1: Mr. Trump sends his youngest child, Barron, to the tony Columbia Grammar and Preparatory School on the Upper West Side, where the annual tuition rings up at a tidy $47,000 per year. In the 17 states that currently offer voucher programs the value of these subsidies ranges from around $4000 to $7000 per year.

Let’s do the math:

private school tuition = $47,000

voucher value* = $7000

———————————————

remaining balance = $40,000

That’s a pretty hefty price tag for a struggling family to cover so their child can attend “the private school of their choice”–and keep in mind: the private school is under no obligation to accept every child who applies. (*New York State does not currently allow private school vouchers, so this is a hypothetical comparison.)

Example #2: Say that the incoming Secretary of Education had a school aged child (she doesn’t) and wanted to send that child to Sidwell Friends School in Washington, DC, the elite private school that has educated the children of Presidents Obama and Clinton, among many other DC notables.

Let’s do the math:

Sidwell school tuition = $39,360

DC voucher value* = $8000

———————————————-

remaining balance = $31,360

That’s still a substantial amount of money for a poor family to come up with to pay the tuition for one child at Sidwell for one year. (*The DC voucher program is not funded for the current school year.)

Now, while there may be private or religious schools with less expensive tuitions, these schools are still not obligated to accept any student who applies. And if vouchers don’t cover all of the expenses associated with a private school education (textbooks, lab fees, uniforms, fees for athletic teams and music instruction, transportation costs, etc.), services and expenses that are usually covered by public school systems, the reality is that poor families are just not going to be able to come up with the remaining dollars.

In addition to creating incentives for advantaged families to leave public schools, school choice programs don’t provide enough money to truly benefit low-income families, Frankenburg said, because the private school tuition is often much higher than what is offered through vouchers. North Carolina’s average school voucher value is $4,116.

“If you want the market to work, you have to provide the market rate, and that’s not something any governmental program has done on a large-scale basis,” Frankenberg said. “You can’t presume schools are going to accept kids, especially kids with special educational needs. If they don’t want to, they don’t have to. And then you also have the issue of the voucher often not being enough for the tuition. It’s easy to see how it looks like an answer. But it’s not a real answer.”

Here’s the truth: the goal of vouchers is not to provide poor children with an opportunity to attend the private school of their choice. That’s nothing more than a cruel “bait & switch” designed to swindle unsuspecting parents out of their hard-earned dollars.

The true goals of vouchers are two-fold:

1. Vouchers provide a government subsidy to wealthy families who are already sending their children to private and religious schools, by redirecting public taxes to private schools.

2. Vouchers siphon away badly needed resources from already defunded public schools, and privilege religious and private schools over public school districts–in effect, privatizing a fundamental American public institution.

Vouchers Don’t Improve Student Learning

Perhaps the most damning indictment of private school vouchers–aside from their unpopularity with the public, the ways that they increase school segregation, and how they don’t provide enough dollars to actually cover the costs of attending a private or religious school–is that vouchers simply don’t work.

A longitudinal study of Ohio’s Education Choice (EdChoice) voucher initiative conducted by the Thomas B. Fordham Institute compared student-level data (i.e., test scores) over a 10 year time period. The researchers found that…

The students who use vouchers to attend private schools have fared worse academically compared to their closely matched peers attending public schools. The study finds negative effects that are greater in math than in English language arts. Such impacts also appear to persist over time, suggesting that the results are not driven simply by the setbacks that typically accompany any change of school.

While these results present a stunning repudiation of the very foundations upon which the voucher movement has been built, what’s equally surprising is who conducted the study. The Fordham Institute is one of the leading conservative education reform think tanks in the nation, and has been a strong, forceful, and powerful cheerleader for school “choice” and private school vouchers for decades. While one must give the folks at Fordham credit for actually releasing these findings, which clearly run counter to the organization’s mission and goals, it’s pretty obvious that the authors and funders of the study found the results particularly painful:

Let us acknowledge that we did not expect—or, frankly, wish—to see these negative effects for voucher participants; but it’s important to report honestly on what the analysis showed and at least speculate on what may be causing these results.

It’s also interesting to note that the PI, or primary investigator, on the report had previously studied the Florida Tax Credit Scholarship program, discussed above:

This is the first study of EdChoice that uses individual student-level data, allowing for a rigorous evaluation of the program’s effectiveness. (Earlier analyses by Matthew Carr and Greg Forster used school-level data to explore its competitive impact.) To lead the research, we tapped Dr. David Figlio of Northwestern University, a distinguished economist who has carried out examinations of Florida’s tax credit scholarship program. He has also written extensively on school accountability, teacher quality, and competition. Given his experience, Dr. Figlio is exceptionally qualified to lead a careful, independent evaluation of Ohio’s EdChoice program.

So what’s the bottom line here?

It’s no surprise that Donald Trump and Betsy DeVos, two billionaires who never attended a public school, never sent their own children to public schools, and never taught in a public school, are “bigly” supporters of private school vouchers.

But it’s important to understand that their arguments for vouchers are, at best, not based on current research and best practices in education, and at worst, dishonest, misleading, and dangerous.