Bill Schuette says he has some “bold new ideas” for Michigan.

Widely expected to run for governor in 2018, Schuette is testing out the planks for his bid at the Republican National Convention in Cleveland this week.

So what are these bold new ideas? Tax cuts and school choice.

In other words, the same stale, failed ideology that Republicans have been pushing on this state since John Engler was first elected governor in 1990.

I suppose it could be called bold in the sense that it’s audacious to continue to advocate for trickle-down economics when tax cuts for the wealthy have time and again failed to produce economic gains, and experts have roundly debunked the theory.

It’s particularly impudent in Michigan, where austerity measures have led to massive disinvestment in everything from our infrastructure to public safety to education at all levels.

These proponents of trickle-down economics have watched as our roads and bridges crumbled. They’ve stood by as crime skyrocketed in our cities. They’ve looked on as class sizes increased in wealthy and poor districts alike, and they did nothing as universities were forced to jack up tuition, creating a whole generation saddled with debt.

Between the Headlee Amendment and Proposal A, Michigan municipalities and school districts are strictly limited in what they can raise through local revenue measures. That makes them reliant on the state for funding. And the state has raided funds for schools and cities year after year, to the tune of more than $6.2 billion over the past decade, in order to plug budget holes rather than do the responsible thing and raise new tax revenue.

In the past 15 years, revenue sharing decreased from $600 million annually to about $250 million. The last year the state fully funded its statutory obligations to local governments was 2001.

In fact, Michigan is the only state in the country providing fewer economic resources to its cities in 2012 than it did in 2002 — by a huge amount.

In Flint alone, revenue sharing cuts have cost the city $55 million, leading to a drastically reduced police force, emergency management, and the fateful decisions that poisoned its water supply and will cost hundreds of millions to remedy.

This spring, Michigan faced a $460 million budget shortfall, largely due to Gov. Rick Snyder’s 2011 business tax cuts.

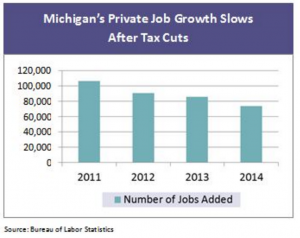

Not only have those corporate tax cuts blown a hole in the budget, they have not spurred economic growth. In every year since they were enacted, the number of new private sector jobs created has fallen, according to the Michigan League for Public Policy.

We have a more than $1.2 billion backlog in road funding needs, just at the state level, $800 million of which will come from the general fund in the coming years – robbing even more from cities and schools.

On the education front, per pupil funding for K-12 education, adjusted for inflation, is still 7.5 percent below pre-recession levels. A 2012 study indicated that the “real value” of Michigan’s per-pupil foundation allowance has dropped 27 percent since 2003 due to state cuts, inflation and districts having to spend more of their revenues on contributions to teachers’ retirement, which was made mandatory in 1995.

As the amount of money going to classrooms has fallen, so has Michigan’s educational rankings – and not just for at-risk students. In 2015, higher-income students in Michigan ranked 48th in the nation in fourth-grade reading.

Unlimited proliferation of charter schools has only further destabilized public education, without resulting in academic gains for students.

Budget cuts to higher education funding have been some of the deepest in the nation, resulting in exponentially higher tuition costs and soaring student loans.

And still, Schuette pushes more tax cuts. Specifically, now that corporate tax revenues have been slashed, Schuette is focusing on income tax cuts, which in Michigan’s flat tax system would disproportionately favor the wealthy.

Don’t get me wrong; I believe the middle class needs a tax break after years of Gov. Snyder’s policies that have shifted the tax burden from the wealthy and corporations to hardworking people. But in our current system, cutting the income tax will only ensure that our roads, schools, cities and universities continue to be underfunded, to the detriment of our economic recovery.

What would be truly bold, in the brave sense, would be for a politician to be honest with citizens about the need for increased revenue, so we can begin reinvesting in education and infrastructure – the things that experts say will bring economic prosperity back to Michigan.

During the 2014 gubernatorial election, I interviewed Democratic candidate Mark Schauer for the MLive Media Group editorial board. When I asked how he intended to pay for increased investment in education, roads and more, he disingenuously gave me the old “by rooting out wasteful spending” line. That line, which he repeated throughout the campaign, was routinely cited as indicative of why he lost.

Anyone with half a brain knows that there isn’t enough waste in the budget to begin to restore the billions in funding cuts over the years. We will need to be smart about raising new revenue, perhaps through a mix of increased corporate taxes and a progressive income tax, and we need a gubernatorial candidate with the guts to make that case to Michiganders.

Until that happens, voters will continue to be swayed by the tax cut snake oil even as we race to the bottom.