In 2013, the U.S. Department of Justice reached a settlement with the giant mortgage bank JP Morgan Chase after they were found to have engaged in fraud that seriously harmed homeowners across the country, many of whom lost their homes entirely. Part of $13 billion settlement – and similar settlements with Citigroup, Wells Fargo, and Bank of America – included mandatory donations to community groups working to help provide relief to impacted homeowners.

In 2013, the U.S. Department of Justice reached a settlement with the giant mortgage bank JP Morgan Chase after they were found to have engaged in fraud that seriously harmed homeowners across the country, many of whom lost their homes entirely. Part of $13 billion settlement – and similar settlements with Citigroup, Wells Fargo, and Bank of America – included mandatory donations to community groups working to help provide relief to impacted homeowners.

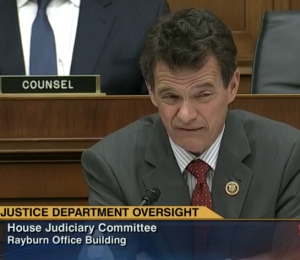

Yesterday, in a Department of Justice oversight hearing, Michigan Congressman David Trott, a former foreclosure attorney who threw countless poor Detroiters and others out of their homes as part of his business, questioned Attorney General Loretta Lynch about the mandatory donations – what he called a “slush fund” to organizations like the Industrial Areas Foundation (IAF) which he describes as “activist organizations”. The money they received as part of the settlement, settlements agreed to by the banks themselves, Trott said, should instead have gone instead to the mortgage bankers.

I’m not kidding:

I wanna talk a little bit about the mortgage settlements. In 2013, activist groups met with the then Deputy Attorney General Tony West and urged him to, in my opinion, create a slush fund to fund their activities in connection with the JP Morgan Chase settlement. Then in 2014, the same groups came back to the Deputy Attorney General and, in connection with the Citi and Wells Fargo settlements, really pushed and accomplished mandatory donations to activist groups, specifically IAF, with enhanced credits for donations to those groups. I wondered if you could comment on whether you think that those discussions occurred, number one, and if they did, why.

As Attorney General Lynch attempted to describe the rationale behind those donations, Trott interrupted her to question why that money wasn’t simply given back to the banks:

I understand how the money was, uh, and how the settlements, the money in connection with the settlements was supposed to be used. What I’m concerned about is IAF, which is specifically an activist group which focuses on community organizing, got tens of millions of dollars with the intent, I believe, of training high school students about the importance of debt management and financial management and I can’t for the life of me understand why that, if you’re really looking trying to curtail future mortgage defaults, why that money wasn’t given to the Mortgage Bankers of America or the different state bar associations that were doing very good work in terms of loan modifications and instead it went to some group that had a different agenda, in my opinion, unrelated to mortgage default activity.

That’s what really would have helped distressed homeowners, you see: Sending tens of millions of dollars to mortgage bankers and lawyers. Those community organizers, why that’s the sort of thing that guy Obama used to do.

This dude doesn’t even bother to pretend he’s not a shill for the mortgage banking industry.

[Hat tip: Marcy Wheeler | Empty Wheel]